Debt problems are hard enough on their own. Add living abroad, a divorce, job loss, and mental health struggles, and the situation can quickly feel unbearable. That is the reality one 35-year-old British man is facing after leaving the UK and trying to hold together debts across two countries.

His situation matters because more people are now living and working overseas while still carrying financial obligations back home. When things go wrong, it can feel like there is no clear path forward — and no system designed to help.

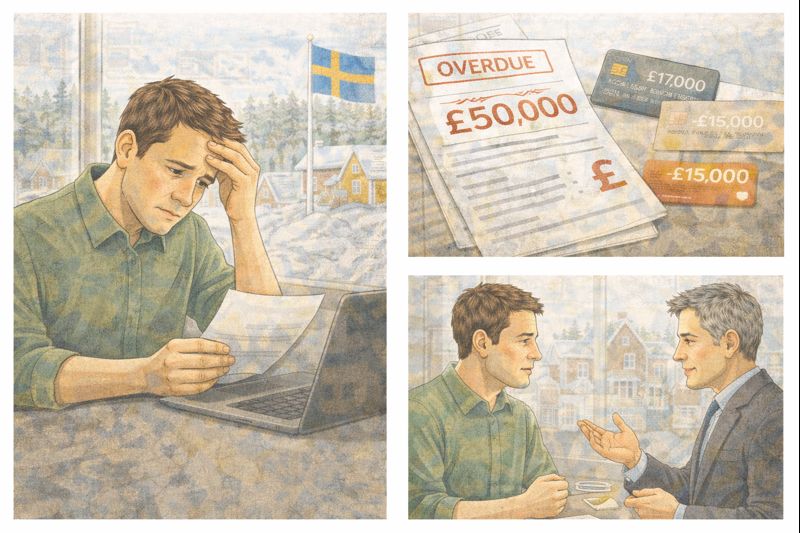

The man explained that he grew up and worked in the UK until 2021, before moving to Sweden. He still travels back to the UK regularly, but his life is now based abroad. Over time, he built up around £50,000 of UK debt, mainly from a personal loan and an American Express card with a large balance.

Alongside this, he now has debt in Sweden. A recent divorce increased his living costs significantly, including rent and child support. For a long time, he managed to keep up with all repayments, both UK and Swedish. But in 2025, he was made redundant. To survive during that period, he took on more loans in Sweden.

He is working again now, but the maths no longer works. After paying rent, child support, and his Swedish debts — which must legally be paid — there is almost nothing left for his UK debts. Until recently, he had managed to make at least the minimum payments on everything. That is no longer possible.

When he contacted American Express, he was told they could not offer help because he had been making the minimum payments. Now that he cannot afford even that, he is terrified of defaulting. He made it clear that he is not trying to run away from his debts. He wants to pay everything back. He just needs time and breathing space.

He also explained that he cannot use a UK IVA because he is no longer resident in the UK, which closes off one of the most common formal debt solutions.

The emotional weight of the situation is heavy. He shared that the pressure has already led to a hospitalisation after a suicide attempt. His message was not about excuses — it was a plea for practical help and kindness.

Situations like this are more common than people realise, and there are some important points worth understanding.

First, creditors like Amex often say they “can’t help” while minimum payments are being made, but that does not mean support is impossible. Many hardship teams only step in once payments are missed or financial difficulty is formally declared. This feels backwards, but it is how many systems work. Asking specifically for a hardship review, explaining the overseas situation, redundancy, and current income clearly, can sometimes lead to temporary interest freezes or reduced payment plans.

Second, defaulting is not the same as “ignoring” debt. Defaulting simply means you cannot meet the agreed terms anymore. It is not a moral failure, and it does not mean the debt disappears. In some cases, defaulting is what allows a more realistic repayment plan to be put in place later.

Third, UK creditors can pursue debts internationally, but enforcement is far more complex and expensive. Often, debts are sold to collection agencies. While this is stressful, it can sometimes lead to more flexible repayment options, especially if you are open and honest about what you can afford.

Fourth, your health matters more than any credit agreement. No debt is worth your life. If finances are pushing you back into crisis, that is a signal that something has to change — even if that change feels scary in the short term.

Practically, the most realistic steps in a situation like this are to stop trying to juggle everything perfectly and instead focus on survival. That may mean prioritising legally enforceable debts where you live, keeping a roof over your head, and protecting your ability to work and support your child. UK debts can often be revisited later, when your situation stabilises.

It can also help to put everything in writing. Sending a clear, calm message to creditors explaining your situation, income, and what you can realistically afford — even if that is £0 for a period — creates a record. Silence creates fear. Communication, even when the news is bad, can sometimes reduce pressure.

Most importantly, this situation is not permanent. Lives do stabilise again after divorce, redundancy, and illness. Debt can be restructured, negotiated, or slowly repaid over time. But none of that is possible if the person carrying it does not survive the weight of it.

For anyone reading this who feels overwhelmed by debt, especially while living abroad, the message is simple and human: you are not broken, you are not alone, and this is a financial problem — not a personal failure.

Help is available

If you’re having thoughts of self-harm or suicide: call 116123 to connect with Samaritans Helpline. It’s free and confidential. You’ll reach someone who is trained to listen and support you.

Leave a comment