A post shared by someone on Reddit has caught the attention of many people who rely on benefits in the UK. The story was shared in the r/BenefitsAdviceUK community and it describes a real experience that shows how a large back payment, which should feel like help, can later turn into a serious problem if people are not fully aware of the rules.

The person who shared the story explained that they had always been careful with money. When they were in their early twenties and able to work, they made a habit of saving. They did not live beyond their means and slowly built up savings of around £10,000. It was not luxury money. It was money set aside for security, in case life became difficult one day.

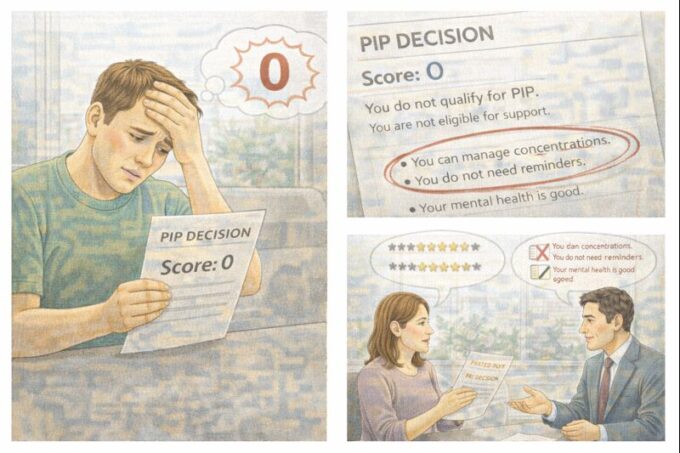

Sadly, life did become difficult. They became disabled and their health declined to the point where they could no longer work or properly look after themselves. They lost their job and had to move back home for support. Their independence disappeared almost overnight, and their plans for the future changed completely.

Over the years that followed, much of their savings were used trying to improve their health and manage daily life. They paid for treatments, support, and extra costs that came with being disabled. None of it led to real improvement. Eventually, their savings dropped to about £6,000.

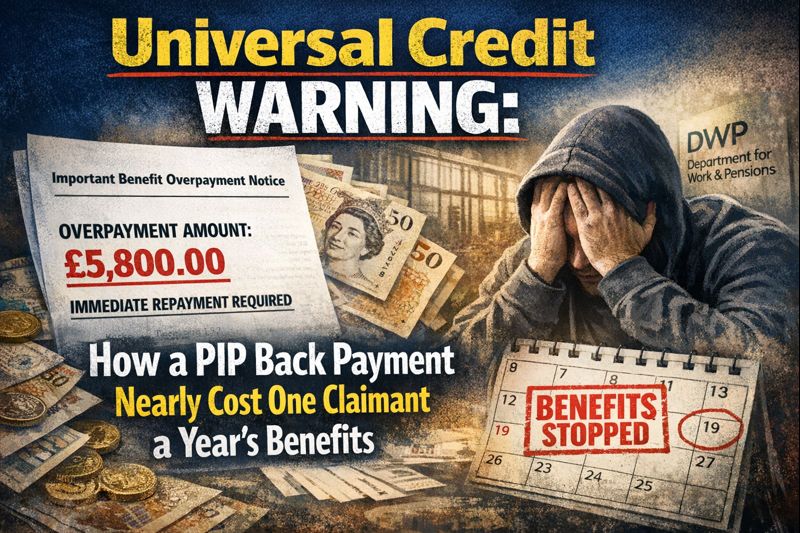

Later on, they were receiving Personal Independence Payment and Universal Credit. Then came what seemed like good news. They received a back payment for PIP. The payment was owed to them because of a delay or error that was not their fault. For many people, a back payment like this feels like relief. It can mean paying off debts, fixing problems at home, or simply having some peace of mind.

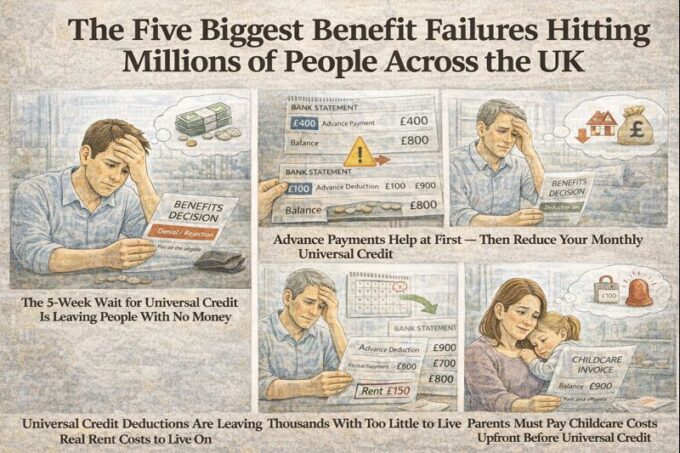

However, once the back payment arrived, their total savings went above £16,000. This is where the trouble began. Under Universal Credit rules, having more than £16,000 in savings usually means you are not entitled to Universal Credit at all.

Worried about this, the person did the responsible thing and contacted the benefits office. They explained where the money came from and asked what they should do. They also explained that they had major work planned on their flat in the coming years so they could live more independently and safely.

They were told on the phone that the back payment would be disregarded because it was paid late due to official error. They were reassured that holding on to the money would be fine. Trusting what they were told, they carried on with their life.

What they were never clearly told was that this disregard only lasts for one year.

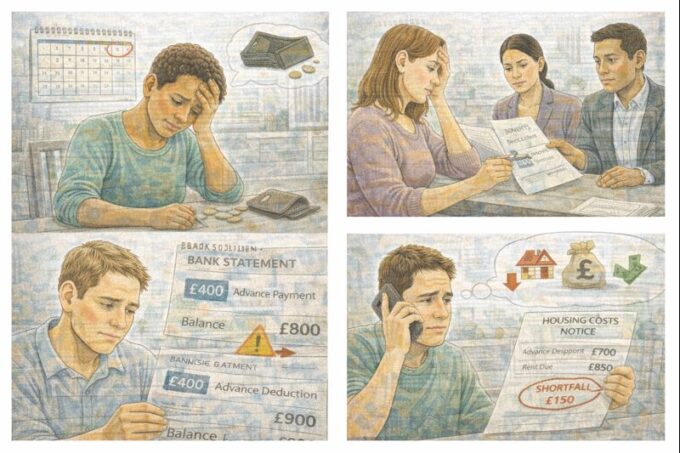

Time passed. The person continued living on a tight budget, managing their health, and planning for the future. Two years later, without any warning, they were contacted for a routine financial review. At first, it seemed like a normal check. But the review turned out to be intense and frightening.

Officials looked through everything. Not just bank accounts, but online services too. PayPal accounts, Revolut accounts, and any place where money could be stored were checked. Every pound was counted.

After the review, they were told they had been over the £16,000 savings limit by around £500 for a whole year. Because of that, they were told they might have to repay an entire year of Universal Credit.

The stress was overwhelming. The person described it as one of the most frightening experiences they had faced in years. Living with a disability is already hard. Living on benefits is already stressful. Being told you might suddenly owe thousands of pounds pushes people to breaking point.

In the end, they avoided having to repay the money, but only because of a technical reason. They were owed around £1,500 in service charges because their managing agent had delayed sending the bill for over a year. That unpaid bill meant their real available savings were technically below the limit.

If that bill had arrived on time, the outcome could have been very different.

The person shared their story to warn others. One of the main points they wanted people to understand is that a disregard on savings is usually temporary. In many cases, it lasts only 12 months. After that, the money counts as normal savings. If you do not reduce your savings below the limit before that time ends, you could be treated as having broken the rules without realising it.

Another important warning is about how savings are counted. It is not just money in a savings account. It includes money in your current account, digital wallets, and online payment platforms. During reviews, officials can and do look at all of them.

The story also clears up a common misunderstanding. Giving money to family or friends to hold onto does not protect you. If the money is still considered yours, it can still be counted as your savings. In some cases, this can even lead to accusations that you deliberately got rid of money to keep claiming benefits.

For many people, this feels unfair and confusing. Saving money is usually seen as a good thing. It is encouraged in almost every part of life. But for people on Universal Credit, saving beyond a certain point can mean losing all support.

Disabled people often face extra costs that others do not. Equipment, care, transport, and home adaptations all cost money. Planning ahead is not a luxury, it is a necessity. Yet the system makes long-term planning very difficult.

The person who shared the story said they believe one of the few safer ways to prepare for the future without affecting Universal Credit is through a pension, as pension savings are usually treated differently. But this is not always realistic, especially for people who become disabled young or who have little spare income.

What makes this story powerful is that it is not about someone trying to cheat the system. It is about someone who saved responsibly, asked for advice, and trusted what they were told. Despite that, they almost faced serious financial punishment because of information that was not clearly explained.

Many people who read the post said they had no idea that disregards were time-limited. Others said they had received back payments and were now worried they might face the same problem in the future. Some said they had only ever been given advice over the phone and now realised how risky that can be.

The story highlights how complicated and unforgiving the benefits system can be. Rules exist, but they are not always explained in plain language. For people dealing with illness, disability, or mental health struggles, keeping track of every detail can be overwhelming.

The message from this experience is simple but important. If you receive a large back payment, do not assume it is safe forever. Ask how long any disregard lasts. Get information in writing if possible. Keep checking your total savings, including online accounts. And get independent advice if you are unsure.

What was meant to be financial help almost became a financial disaster. By sharing their experience on r/BenefitsAdviceUK, the person hopes others will be better prepared and avoid the same fear and stress.

Leave a comment