Being asked to act as a guarantor for a family member’s loan can put someone in an impossible position. On one hand, there is guilt, loyalty, and the desire to help. On the other, there is fear about credit damage, long-term financial risk, and the reality that things could go wrong. More people are now finding themselves in this exact situation as household debt rises and lenders tighten their rules.

In this case, a homeowner was asked by their sister to be a guarantor on a loan taken out to cover rent and council tax arrears. The sister works, but her husband was out of work for a period last year due to serious illness and hospitalisation. During that time, bills piled up and debt grew quickly. With poor credit, their only option now appears to be a guarantor loan with an eye-watering interest rate of 43% APR, spread over three years, with repayments of around £250 a month.

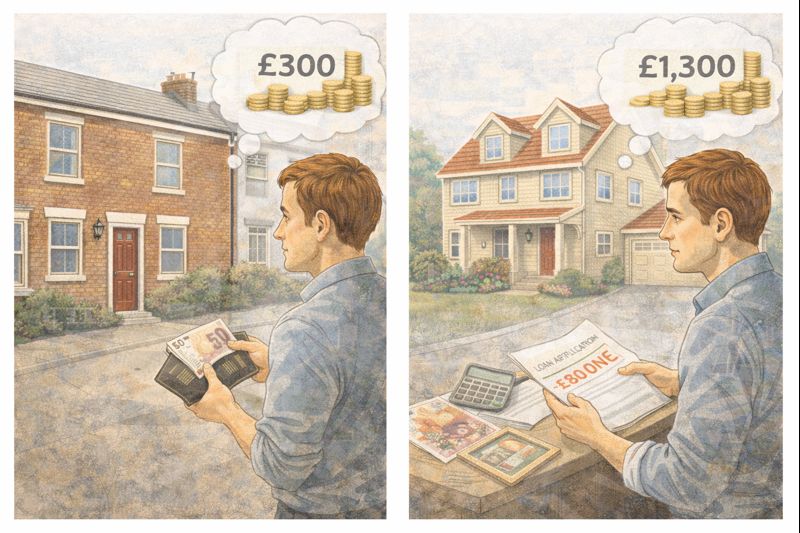

That repayment figure alone is raising alarm bells. For a household already struggling to keep up with essential bills, committing to £250 every month for three years is a huge risk. If payments are missed, the responsibility immediately falls on the guarantor. That means the homeowner who signs could be legally required to pay the debt in full, even if their own finances are already stretched.

Financial advisers consistently warn that guarantor loans are among the riskiest forms of borrowing, not just for the borrower but especially for the guarantor. Any missed or late payment can affect the guarantor’s credit file. In some cases, the loan itself appears on the guarantor’s credit record. This can reduce borrowing power, increase mortgage interest rates in the future, or even lead to rejection when remortgaging.

For someone who has worked hard to rebuild their credit after past financial problems, the risk feels even greater. A single missed payment by someone else could undo years of effort. That fear is not exaggerated. Mortgage lenders look closely at credit history, outstanding liabilities, and financial associations. Acting as a guarantor ties your financial future to someone else’s ability to pay.

There is also the emotional pressure. Saying no feels heartless, especially when illness played a role in the situation. But experts are clear on one point: being a guarantor is not a small favour. It is a legal and financial commitment that should be treated as if you are taking out the loan yourself.

In situations like this, there are usually safer alternatives that should be explored first. Councils often have discretion to arrange council tax repayment plans, even if someone is in arrears. While being told “no” because of the new financial year sounds final, advisers suggest this is often not the end of the conversation. Councils can spread arrears over longer periods, reduce payments temporarily, or reassess circumstances, especially where illness is involved.

There are also debt advice charities that can help negotiate with creditors, including councils and landlords. These organisations can sometimes secure more manageable repayment plans, pauses on enforcement, or access to hardship funds. For people in council housing, there may also be support schemes linked to housing stability and preventing arrears from escalating further.

Another important point is the loan itself. A 43% APR loan is extremely expensive. Over three years, the total amount repaid could be far higher than the original debt. High-interest loans often solve short-term pressure while creating long-term damage. Once payments start, there is little flexibility if circumstances worsen again.

Experts also caution against borrowing to pay off priority debts without professional advice. Council tax and rent are priority debts, but replacing them with high-interest consumer debt can sometimes make the overall situation worse, not better.

For the person being asked to act as guarantor, the advice is clear but difficult. You are allowed to say no. Protecting your own financial stability is not selfish. You can still help without putting your credit, mortgage, and future at risk. Helping might mean supporting them to contact the council again, helping them find free debt advice, or assisting with paperwork rather than signing a legal guarantee.

There is also the reality that family loans and guarantees can damage relationships. If payments are missed and the guarantor is chased, resentment and guilt can build on both sides. Many people say the financial stress lasts far longer than the original debt.

Debt advisers often suggest a simple test: only agree to be a guarantor if you could comfortably afford to repay the full loan yourself without hardship, and without it affecting your long-term plans. If the answer is no, the risk is too high.

This situation highlights a wider issue facing many households. Illness, job loss, and rising living costs can push families into debt very quickly. When credit options disappear, pressure shifts onto relatives who appear more financially stable. Without clear advice, those relatives can end up carrying risks they never intended to take on.

In the end, helping does not have to mean sacrificing your own financial future. Sometimes the most responsible support is helping someone find the right advice, not signing your name to a loan that could follow you for years.

Leave a comment