An update posted recently on a UK personal finance forum has drawn attention to the intense pressure faced by people dealing with large tax debts, and the hidden mental health toll that can come with financial crisis. It offers a stark reminder that behind every debt figure is a real person trying to cope, survive, and rebuild.

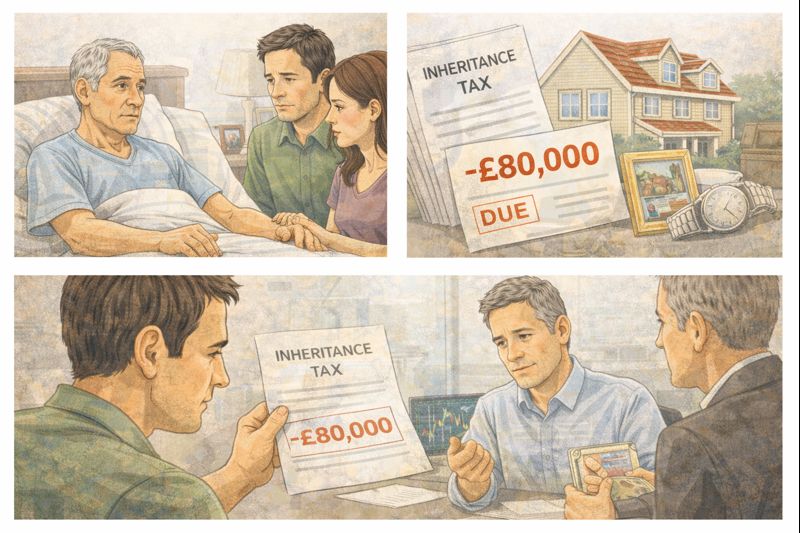

The individual had previously faced an £82,000 HMRC tax bill and was told they would not be allowed a formal payment plan. At the time, their situation had already been spiralling. Their business income had collapsed due to rapid changes in their industry, particularly the impact of AI, leaving them working long hours for very little return. Alongside the financial strain came deep shame and isolation, emotions that made it harder to ask for help or explain how things had reached that point.

In the months following that earlier post, things reached a breaking point. The individual describes being in a very dark mental place, dealing with severe depression while trying to keep their business afloat. After reading some harsh responses online, they experienced a serious mental health crisis and made an attempt on their life. They survived only because their partner found them by chance. They were hospitalised, sectioned for a period, and are now receiving ongoing therapy.

That support, they say, has made a huge difference. Being open with their partner rather than carrying everything alone has lifted much of the emotional weight. They also shared a clear message for others: words matter. Online comments can have real-world consequences, especially for someone already on the edge.

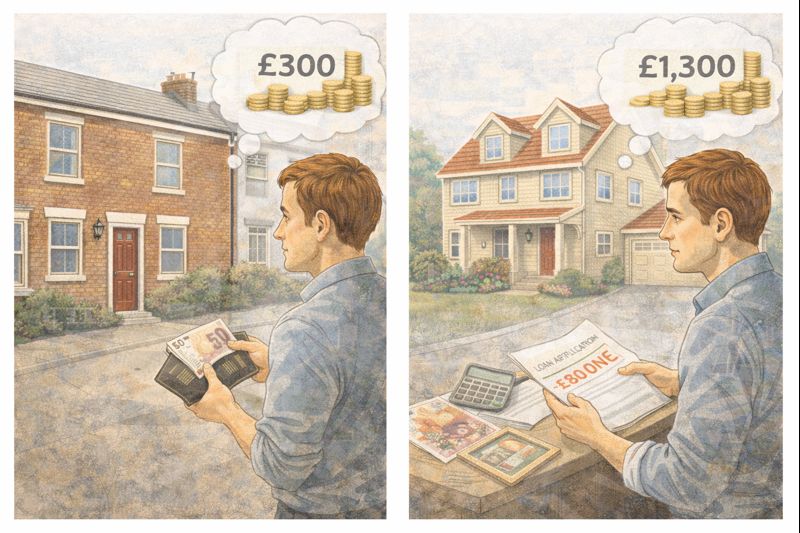

On the financial side, the picture is slowly improving, even without formal help from HMRC. Over the past year, the individual has been paying between £1,500 and £3,000 per month towards the debt. They are paying what they can while still maintaining a basic quality of life, keeping their home and caring for their pets. Although the balance remains high, it is steadily falling, and that progress has brought a sense of hope.

HMRC has not agreed to a structured payment plan, even after being informed of the mental health crisis. However, the individual reports that enforcement action has eased. They are not being actively chased, and the threat of bankruptcy is no longer hanging over them. Their account has been moved to a newly created “Extra Support” team, suggesting a quieter, more hands-off approach as long as payments continue.

To prevent the situation from repeating itself, major changes have been made. The business has been restructured into a limited company, reducing personal tax exposure and making it easier to manage future liabilities. An accountant has been hired, and tax money is now set aside properly. The individual is clear that lessons have been learned the hard way.

They also worked intensively to pivot their business into a new area, and that effort is finally starting to pay off. Income is improving, stability is returning, and for the first time in a long while, the future does not feel completely overwhelming.

There are also personal milestones ahead. A short holiday is planned, and an engagement is expected during the trip. That contrast — between how close they came to losing everything and the life they are now rebuilding — is something they describe as deeply emotional.

This update highlights several uncomfortable realities. HMRC does not always offer formal payment plans, even for very large debts and even where mental health is involved. Many people end up in informal arrangements, paying what they can and hoping enforcement stays paused. It also shows how quickly financial pressure can turn into a mental health emergency when someone feels trapped, judged, or ashamed.

Perhaps the most important message is a human one. Financial mistakes do not make someone worthless. Struggling does not mean someone is lazy or irresponsible. And harsh words, especially online, can push vulnerable people further than anyone realises.

While the debt will take years to clear, there is now a sense of direction instead of despair. The balance is going down. Support is in place. The business is stabilising. Life is moving forward again.

For anyone facing a similar situation, this serves as a reminder that even when the numbers feel impossible and help feels out of reach, survival itself is a form of progress. And for those offering advice or opinions online, it is a reminder that there is always a person on the other side of the screen.

Leave a comment