Most personal finance advice sounds sensible on paper, but many families quietly discover it falls apart in real life. Saving tips, pension projections, and investment strategies are often written as if people live alone, earn predictable incomes, and never face illness, children, or unexpected responsibility. Add a partner, kids, or ageing parents into the mix, and those neat rules can suddenly feel useless.

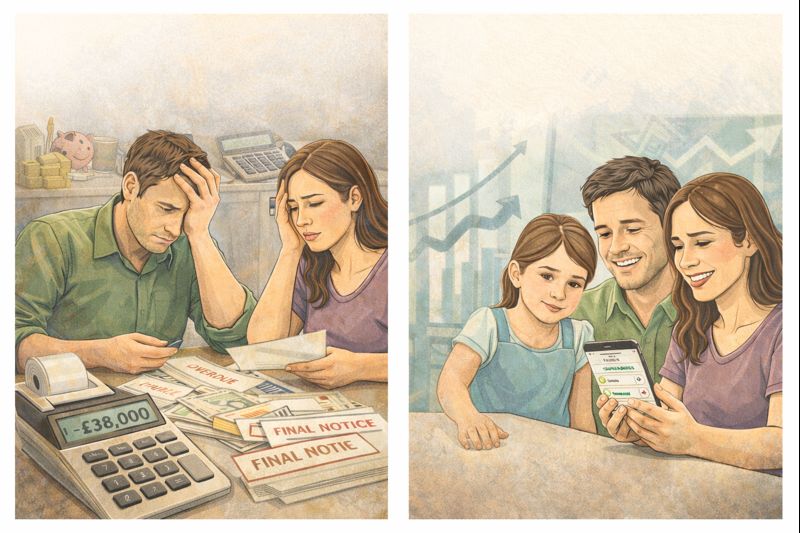

A long-time fintech professional with a decade of experience has shared a different way of thinking about money — one that prioritises resilience and peace of mind over squeezing out the highest returns. After years working in the industry, being married, and raising children, he says the biggest financial risk he noticed wasn’t his pension balance or investment performance. It was the realisation that if something happened to him tomorrow, his wife would be locked out of almost everything.

Like many households, he had quietly become the “financial operator”. All the passwords, logins, bills, utilities, and subscriptions lived in his head or his devices. If he suddenly became ill, incapacitated, or died, his partner wouldn’t even know where to start. That single insight changed how they approached money completely.

Instead of focusing on optimising investments, they built what they now call a “family system”. The goal wasn’t wealth maximisation. It was continuity. Making sure life could keep functioning even if one person was removed from the picture.

The first step was shared access. Every account — banking, utilities, insurance, subscriptions — is stored in a shared password manager. In many households, one person controlling all logins feels efficient. In reality, it creates a single point of failure. When that person is unavailable, the household is stuck. Sharing access isn’t about mistrust. It’s about removing unnecessary risk.

Next came what they call a “break glass” document. This is one physical page, backed up digitally, that lists every key account, policy number, and important contact. It’s not a detailed manual, just a clear map of where everything lives. In a crisis, when stress and grief make thinking hard, this document gives the other partner a starting point instead of a wall of confusion.

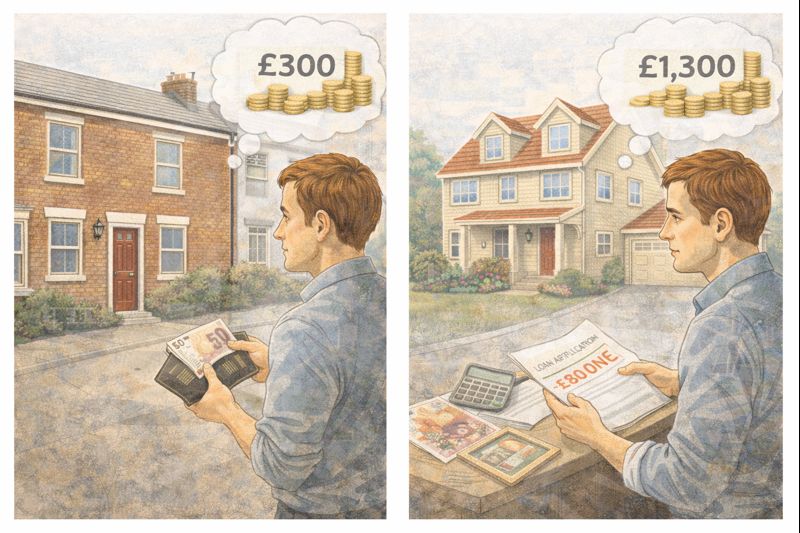

Legal preparation followed. Wills were updated and Lasting Power of Attorney was put in place. This is one of the most overlooked areas in family finance. Many people assume marriage or joint accounts are enough. They’re not. If one partner loses mental capacity through illness or an accident, banks can freeze assets, even shared ones. Sorting this out costs a few hundred pounds, but it can prevent years of legal and financial chaos.

They also rethought how money flows through the household. Over years in fintech, the writer says he has seen more relationships damaged by “fairness” than by debt. Couples start tracking who pays what, who earns more, who spent more. That scorekeeping slowly breeds resentment.

Their solution was to treat the joint account like a business account. Mortgage, bills, food, children’s costs — everything essential goes out automatically from one place. Once money enters that account, it stops being “mine” or “hers”. It becomes household money, with no emotional strings attached.

At the same time, they created something surprisingly powerful: a “no questions asked” personal allowance. Each month, a fixed amount is transferred automatically into each partner’s personal account. That money can be spent on anything — gadgets, clothes, hobbies — without discussion or judgement. No asking for permission. No passive-aggressive comments. No scrolling through transaction histories.

This single change removed a huge amount of tension. It preserved personal freedom while protecting shared goals. It also stopped small purchases from turning into arguments that weren’t really about money at all.

Emergency savings were treated differently too. Standard advice often suggests three months of expenses. For families, that figure felt unrealistic. Household costs don’t shrink easily. You can’t stop feeding children or heating the home because income drops. So they aim for six months or more, accepting that security matters more than textbook optimisation.

Money education for children is another area where traditional advice often misses the mark. Lectures don’t work. Kids learn by watching. Instead of simply saying “no” to spending, they narrate choices out loud. Not buying a toy isn’t framed as deprivation, but as a trade-off in favour of something else, like a holiday. Children learn that money is finite and every decision has a consequence.

As the children grow older, the plan is to move away from piggy banks and towards real numbers. Showing Junior ISA graphs, watching money grow over time, and seeing compound interest in action helps make abstract ideas real. Screens and data, not lectures, make it click.

The most important money conversation, though, is planned for the moment their children get their first job. They want to sit down and go through a payslip line by line. Income tax, National Insurance, pensions. The lesson is simple but powerful: the headline salary is not what you live on. Budgeting must be based on what actually arrives in your account, not what a job offer promises.

Alongside what works, the writer also highlighted warning signs he’s seen repeatedly. One person controlling all finances is a major risk. Money never being discussed in front of children leaves them unprepared. Not knowing monthly household spending creates blind spots. And elderly parents managing complex finances alone while showing signs of cognitive decline can lead to disaster if ignored.

The framework isn’t presented as perfect or universal. It’s practical, lived-in, and designed for real families rather than spreadsheets. The core message is that good financial planning isn’t just about numbers. It’s about reducing fragility.

In a world where income, health, and technology can change suddenly, families don’t just need better returns. They need systems that keep working when things go wrong.

Leave a comment