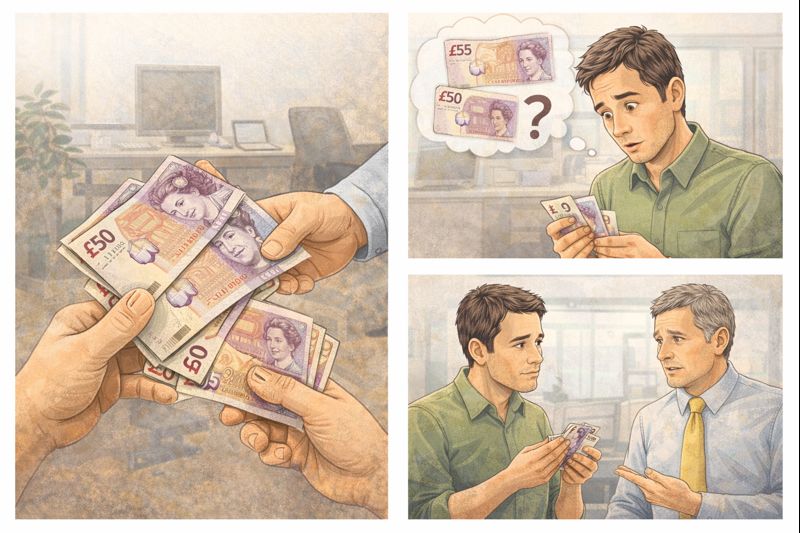

Mistakes at work do not always come as missing pay. Sometimes they arrive as a pleasant surprise — and then turn into a problem. That is exactly what happens when an employer awards the wrong amount, an employee uses it in good faith, and the company later realises the error.

Situations like this feel uncomfortable because they sit somewhere between fairness, legality, and workplace relationships. The short answer is that yes, in most cases you are still liable to repay money or benefits that were paid to you by mistake, even if the error was entirely the employer’s fault and even if you have already spent it. But how that repayment happens, and what your employer is allowed to do, matters a lot.

Under UK law, money or benefits paid due to a genuine clerical or administrative error are usually classed as an overpayment. The key point is that the employer did not intend to give you £250. Their intention was £25. Once the error is identified, they are generally entitled to recover the difference.

The fact that the reward came through a company rewards scheme rather than payroll does not change that principle. Vouchers, credits, and non-cash rewards are still considered a financial benefit. If the amount was incorrect, the employer can ask for the overpaid portion back.

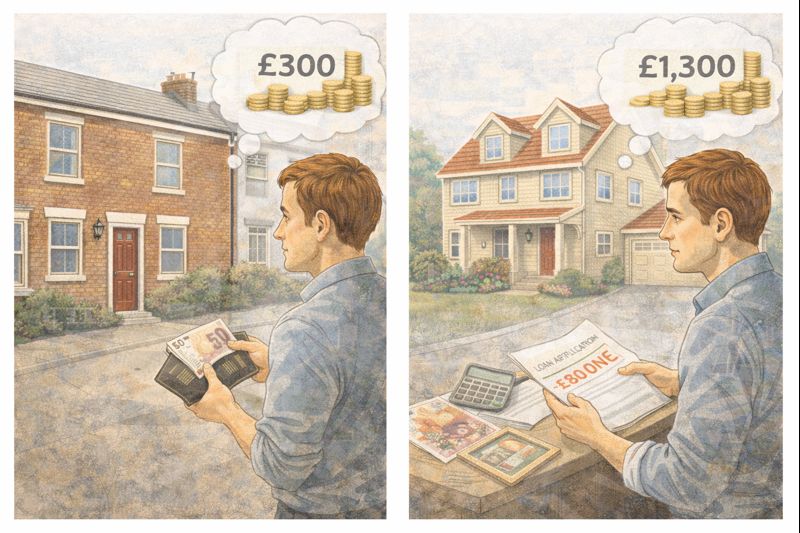

Spending the money does not automatically protect you. The law usually looks at entitlement, not whether the funds are still available. If you were not entitled to £250, then the company can argue that you have been unjustly enriched by £225.

That said, there are important limits on how an employer can recover it.

An employer cannot simply deduct money from your wages whenever they like. Even when an overpayment has occurred, deductions from pay are tightly regulated. In most cases, the employer must either have your written consent or a clear contractual clause that allows deductions for overpayments.

Many employment contracts do include wording that allows recovery of overpaid wages or benefits. If yours does, they may be legally allowed to deduct the amount from your future pay, but even then, the deduction must be reasonable. They cannot reduce your pay below National Minimum Wage for the pay period unless you agree.

If there is no such clause, they should ask you to repay the amount rather than taking it automatically. This is often done by agreement, sometimes spread over several pay periods.

Another important factor is good faith. You received an official email stating that you had been awarded £250. You did not manipulate the system or mislead anyone. You reasonably believed the award was correct, especially given that the work involved overtime and prevented external contractors being called in. That does not erase the debt, but it does strengthen your position when discussing how repayment should happen.

Courts and tribunals tend to look unfavourably on employers who try to aggressively recover small sums without considering fairness or proportionality. In practice, many employers choose not to pursue recovery at all for modest amounts, or they write off part of it as a goodwill gesture.

The fact that your colleagues’ awards were quietly adjusted before being claimed suggests the company recognised the error early in other cases. You were simply unlucky in being the one who redeemed it quickly.

What you are not legally protected from is the obligation itself. There is no automatic rule that says “their mistake, your money”. That is a common myth. If the amount was not intended for you, it can usually be reclaimed.

However, you are protected from sudden or punitive action. Your employer should not discipline you, accuse you of wrongdoing, or make unauthorised deductions. This is an administrative mistake, not misconduct.

The sensible next step is to respond calmly and in writing. Acknowledge that you understand there was an error. Explain that you claimed and used the voucher in good faith, based on the official notification. Ask how they would like to proceed and make clear that any repayment would need to be agreed and affordable.

In many workplaces, this leads to a compromise. Some employers ask for repayment of the difference. Others deduct a small amount over time. Some decide it is not worth the damage to morale and leave it alone.

Legally, the company has the right to recover the overpayment. Practically, how they handle it says a lot about their culture.

So while you are not automatically “off the hook”, you are also not required to hand over money immediately or accept an unexpected wage deduction without discussion. This is a situation where a calm, cooperative approach usually leads to the best outcome — and where the law offers protection against heavy-handed recovery, even if it does not erase the debt entirely.

Leave a comment