For many people, paying off a mortgage feels like the finish line. It is the moment when the biggest monthly bill finally disappears, often after decades of work and sacrifice. But in reality, it is not the end of financial planning. It is the start of a new phase, one where the focus shifts from survival and debt to security, choice, and peace of mind. That shift can feel confusing, especially for people who have spent most of their adult life just trying to keep up.

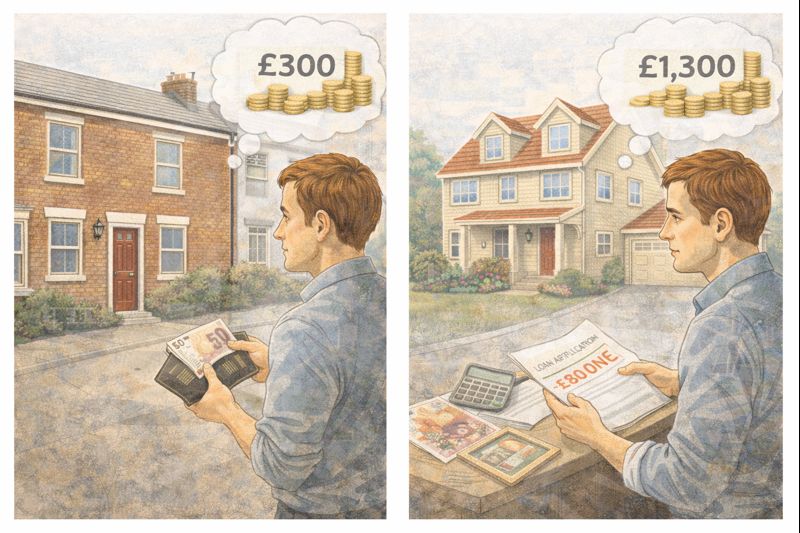

That is the position a 56-year-old man recently found himself in. He works full time, earns around £30,000 a year, and is just five months away from clearing the last £100 of his mortgage. For the first time in years, he can see a future where he owns his home outright. Now he wants to do something sensible with the money that will soon be freed up, ideally putting £100 to £200 a month aside.

He explained that his finances are mostly under control. He has a couple of small loans and a PCP agreement for a scooter, costing around £100 a month in total. He also has about £2,000 on a 0% credit card. None of these feel overwhelming, but they are still there. He already has a savings account, but the interest is very low and feels pointless. He is not looking for anything fancy, just a better place to put money away regularly.

His home life is stable. He owns the property and lives there with his partner. She keeps her own rented house where her son lives. He mentioned she is not particularly good with money, but said that this is not currently causing problems. His aim is to focus on his own financial security as he gets older.

When others responded, they did not jump straight to investments or complicated products. Instead, they stepped back and looked at the bigger picture. The first thing they pointed out was that the “best” place to put money depends on what it is for. Money you might need soon should be treated very differently from money you are happy to lock away for years.

Several people suggested starting by cleaning up what is already there. The small loans, the PCP, and the 0% credit card are not emergencies, but they do limit flexibility. Clearing them removes mental clutter as much as financial risk. There is something powerful about knowing your monthly income is mostly yours, not already spoken for by old commitments.

The credit card, in particular, came up as something to watch closely. A 0% balance can feel harmless, but the danger comes when the interest-free period ends. Clearing it before that happens avoids stress and sudden high interest later on. It is an easy win that makes everything else simpler.

After that, people talked about emergency savings. This is not exciting money. It is not there to grow quickly. It is there so that when something unexpected happens, you do not panic or reach for credit. For someone still working, many people aim for three to six months of basic expenses. That sounds like a lot, but it builds slowly. Even £100 a month adds up over time.

The man asked about cash ISAs and interest rates, and this is where things became more practical. A cash ISA is not a special investment. It is simply a tax-free savings account. The main benefit is that any interest you earn is yours to keep. Right now, there are cash ISAs and easy-access savings accounts paying much better rates than older accounts, often around four percent or more, depending on conditions. For money you want to keep safe and accessible, this can be a big improvement over a “crap” savings account.

People also explained that investing is an option, but not a starting point. Stock market investments make more sense for money you can leave alone for at least five years, ideally longer. At 56, investing is still possible, but it should come after the basics are covered. Security matters more than chasing high returns.

What makes this situation interesting is how common it actually is. Many people reach their 50s with a paid-off or nearly paid-off home but feel unsure what to do next. They have spent so long focusing on the mortgage that saving and investing feel unfamiliar. The temptation is to look for a perfect product or a clever strategy. In reality, the most important thing is habit.

Once the mortgage is gone, the monthly payment does not have to disappear. It can be redirected. Turning that old mortgage payment into a regular saving habit is one of the simplest and most powerful moves someone can make. The money was already leaving your account. Now it can work for you instead of the bank.

Another quiet but important point is independence. Owning your home outright and having your own savings gives you options. It reduces stress if work changes. It protects you if relationships change. It gives you choice later in life, when energy and income may not be the same as they are now.

This is not about becoming wealthy overnight. It is about building a soft landing for the future. Clearing small debts, keeping cash for emergencies, and saving steadily are not exciting, but they are effective.

For readers in a similar position, the lesson is simple. When the mortgage ends, do not rush into complicated investments. Pause. Clean up what you owe. Build a safety net. Find a decent home for your cash. Then, if and when you are comfortable, you can think about taking on more risk.

At 56, being nearly mortgage-free is already a win. What comes next is about protecting that win and making sure it lasts.

Leave a comment