Being turned down for a loan can feel unsettling, especially when everything looks fine on the surface. You have a steady income, you own a home, your bills are up to date, and a comparison site has even told you that approval is “guaranteed”. When the answer still comes back as no, it leaves people confused, anxious, and often blaming themselves without really understanding what went wrong.

In this case, the person needed to borrow between £10,000 and £20,000 fairly urgently. They earn £38,000 a year, own their home, and do not see themselves as reckless with money. Their credit score is not perfect, but it is not terrible either. From their point of view, there was no obvious reason to be rejected.

The first rejection came from their mortgage provider, even though the provider had advertised loans that would not impact a credit score. That was disappointing but not alarming. The real shock came next, when a credit broker showed a 100 percent chance of approval for a £20,000 loan, only for the lender to later decline it after asking for more information.

This is where many people start to feel misled. Those “guaranteed” approvals are based on limited data. They rely on what the broker can see, not on the full picture a lender uses. Once a lender asks for deeper access, such as a year of bank transactions, the decision is completely reassessed.

The request for bank statements is often the moment where things change. Payslips only show what someone earns. Bank statements show how they live. They show rent or mortgage payments, food costs, subscriptions, car finance, credit card spending, overdrafts, and how often money is tight at the end of the month. From a lender’s point of view, this matters far more than the headline salary.

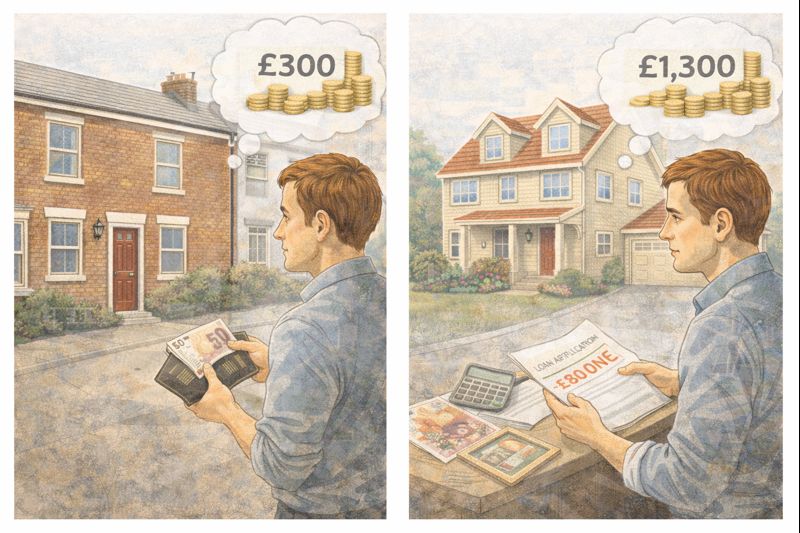

When a lender looks at statements, they are asking one simple question: if we add another large monthly repayment, will this person still cope without falling behind? For a £20,000 loan, repayments could easily be £300 a month or more. Lenders usually want to see a healthy buffer above that, often several hundred pounds of spare money every month, even after all regular spending.

This is why income alone does not guarantee approval. Someone can earn £38,000 and still not have enough true disposable income once everything else is taken into account. Regular spending on credit, car finance, subscriptions, childcare, or even frequent small expenses can all add up and reduce affordability.

The person also worried that being declined meant they were now “screwed” for six months. In reality, that is rarely the case. A single declined application does not lock someone out of borrowing. Even a couple of hard searches are usually not fatal. What causes problems is repeated applications in a short time, which can make someone look desperate for credit.

It is also worth understanding the difference between soft and hard searches. Pre-approvals and eligibility checks are usually soft searches. They are visible but have little impact. A full application may involve a hard search, which lenders can see. One or two of these is normal. The damage comes from stacking many of them quickly.

Another source of confusion is why the lender would bother asking for more information if the credit check was going to fail anyway. The answer is that the initial check may have passed. It is only once affordability is tested properly that the problem appears. Nothing “suspicious” needs to be present. It can be as simple as not enough spare money each month on paper.

Several people also pointed out that borrowing £20,000 unsecured on a £38,000 salary is a big ask in today’s lending environment. Rules are tighter than they were years ago. Lenders are cautious, and they would rather say no than risk someone struggling later.

Some suggested stepping back and reassessing whether the full amount is really needed, or whether the problem could be solved in stages. Others mentioned alternatives like 0 percent credit cards, which can work for some people, but only if they are disciplined and confident they can repay before interest starts.

Applying through your main bank was another suggestion. Your bank already sees your income and spending and may offer more tailored products or better rates. It does not guarantee approval, but it can remove some of the uncertainty.

What comes through clearly is that comparison sites are not promises. They are rough guides. They do not see everything, and they do not make the final decision. That decision is always made by the lender, using their own rules.

For readers, the key takeaway is this. If a loan is declined after bank statements are reviewed, it usually means the lender does not believe the monthly repayments fit comfortably into your life as it is now. It is not a judgement on your character or honesty. It is a risk calculation.

Before applying again, it is often better to pause, look honestly at monthly spending, and consider whether the borrowing amount can be reduced or the plan changed. Pushing more applications rarely helps. Understanding what lenders are really looking for does.

In today’s system, affordability is king. What matters most is not how much you earn, but how much room you truly have once life has taken its share.

Leave a comment