When families start to grow, housing decisions suddenly become urgent and confusing. For many people, especially those already juggling children, work, and rising costs, the idea of “upsizing” can feel overwhelming. Mortgage maths is often explained in a way that assumes everyone already understands it, which leaves people feeling stupid for asking perfectly reasonable questions.

That is exactly why one family, expecting their third child, asked for help. They already own a three-bed home, but space is becoming tight. They are now weighing up whether it makes more sense to move to a bigger house or stay put and pay for a loft conversion. Before even thinking about that choice, they want to understand one basic thing: if they sell their current house and buy a more expensive one, how much mortgage would they actually end up with?

They shared their numbers clearly. Their current home is worth somewhere between £265,000 and £275,000. The outstanding mortgage balance is £129,315. That total includes a main mortgage and an additional amount borrowed previously for extension work. The type of four-bed home they need is likely to cost around £350,000.

The key thing many people misunderstand is this: when you sell your house, you do not “start again” with the full price of the new house. What really matters is the equity you already have.

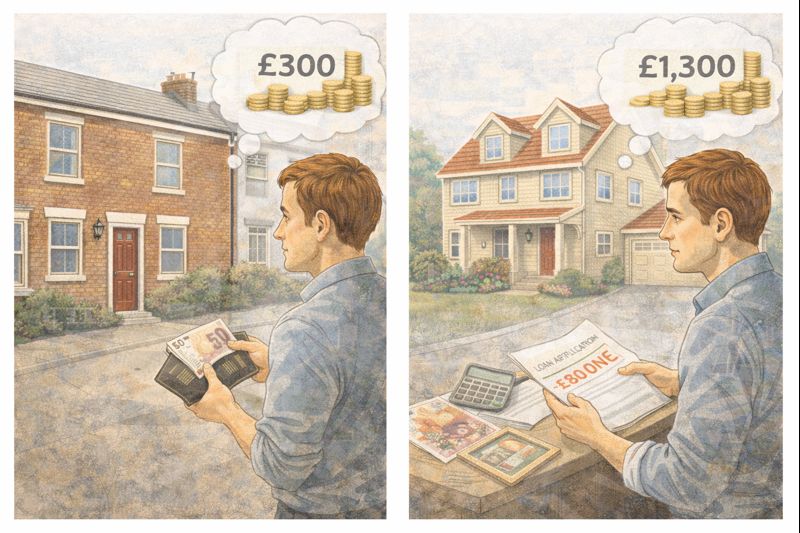

Equity is simply the value of your home minus what you still owe on the mortgage. If we take a middle value for the current home, say £270,000, and subtract the outstanding mortgage of about £129,000, that means there is roughly £141,000 of equity in the property.

When the house is sold, the mortgage is paid off first. What is left over is your equity, and that equity becomes the deposit for your next home.

So if they sell for around £270,000 and buy a new house for £350,000, the maths becomes much simpler than it first appears. Take the £350,000 purchase price and subtract the £141,000 equity. That leaves roughly £209,000.

That £209,000 is the new mortgage they would need, before fees, stamp duty, or moving costs.

In very simple terms, they are not borrowing the full £350,000. They are only borrowing the difference between the new house price and the value they already own in their current home.

This is why upsizing often feels expensive even when people already own a house. Their mortgage balance may rise significantly, even though they are not “starting from zero”.

Of course, there are extra costs to consider. Stamp duty on a £350,000 home, legal fees, estate agent fees, and moving costs will add to the total. These are often paid from savings or added to the mortgage, which can push the final borrowing amount higher.

But at its core, the mortgage calculation is straightforward. New mortgage equals new house price minus current equity.

This also explains why some families consider staying put and extending instead. A loft conversion or extension might cost £40,000 to £70,000, but it avoids stamp duty, avoids moving costs, and avoids increasing the mortgage as much as buying a new home would.

On the other hand, extensions come with disruption, building stress, and the risk that the finished home still does not meet long-term needs. A bigger house might offer a cleaner solution, even if it costs more on paper.

What many commenters often point out in situations like this is that affordability is not just about the mortgage size. It is about the monthly payment. Interest rates, mortgage term length, and household income all play a big role. A £210,000 mortgage at a low rate over 25 or 30 years may be perfectly manageable, while the same mortgage at a higher rate could feel tight.

The important takeaway for anyone reading is this: upsizing does not mean throwing away what you have already paid. Your existing home has real value that carries forward with you. The mortgage only needs to cover the gap.

For families feeling confused or intimidated by the numbers, this kind of breakdown often brings relief. Once the maths is stripped back to basics, the decision becomes less scary and more about lifestyle, space, and what works best for the family’s future.

Asking to have it explained “like an idiot” does not mean the question is silly. It means the system is.

Leave a comment