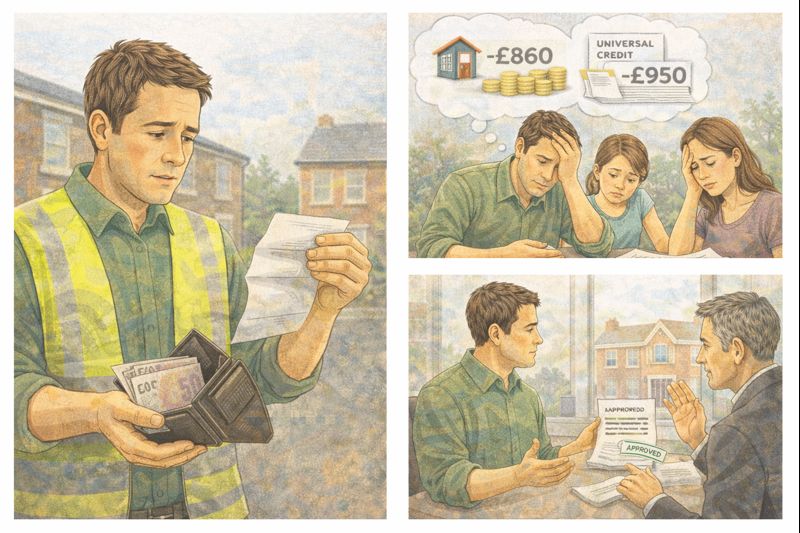

Rising rents and changes to Universal Credit are pushing many working families into impossible situations, and one tenant’s experience shows how quickly things can spiral when transparency breaks down between a landlord and a claimant.

After renting the same house for around 13 years, the tenant believed the rent had always been £700 a month. This was based on an agreement with the landlord, who had told them that Universal Credit was only paying around £500 directly to him and that the tenant needed to top up the rest. Wanting to keep the roof over their family’s head, the tenant agreed and paid the difference without issue.

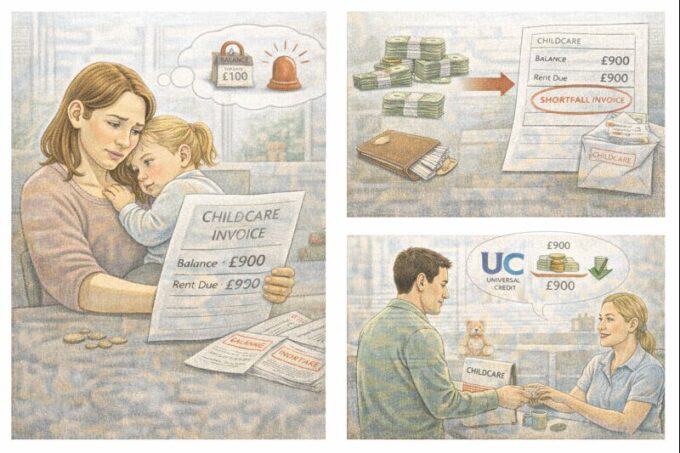

Everything changed when they recently discovered that Universal Credit had, in fact, been paying the full £700 rent to the landlord for the entire time. This meant the tenant had unknowingly been paying extra money on top of a rent that was already fully covered.

The situation became even more serious after the tenant started a new job. Because their earnings increased, Universal Credit stopped paying housing costs altogether. That’s when the landlord claimed that the rent had “always” been £900, not £700, and demanded the higher amount going forward.

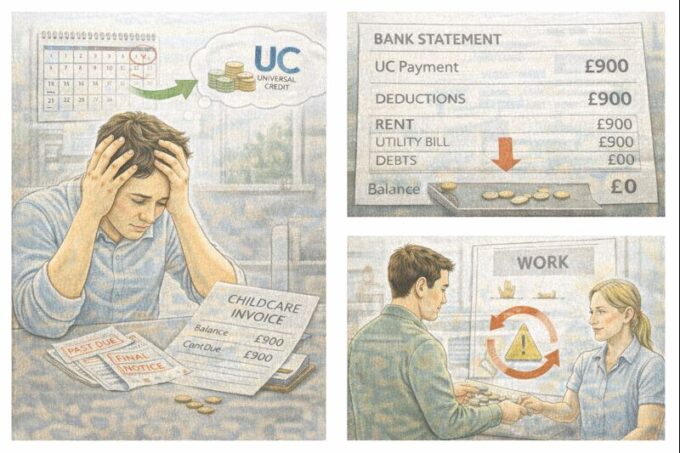

For the tenant, this created an immediate crisis. With two children over 16 still living at home and rising living costs across the board, paying £900 a month in rent simply isn’t possible. Despite working, their income does not stretch far enough to cover full rent plus bills, food, and other essentials. They now feel trapped between earning “too much” to qualify for help and earning too little to live securely.

This kind of situation is more common than many realise. When Universal Credit pays rent directly to a landlord, tenants often rely on what they’re told and don’t always see clear records of what is being paid. Over time, misunderstandings — or worse, misrepresentation — can go unnoticed, especially when people are just trying to survive month to month.

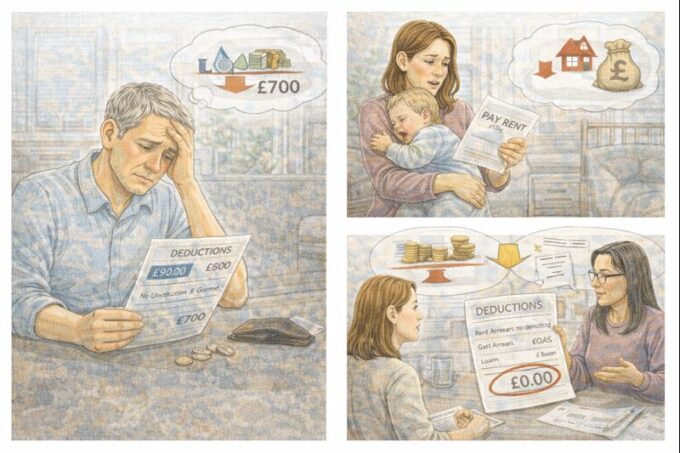

There are a few key issues at play here. First is the question of proof. Rent amounts should always be clearly stated in a tenancy agreement. If the written agreement says £700, the landlord cannot simply change it to £900 without following the proper legal process. A rent increase usually requires formal notice, and in many cases, justification, especially if the increase is large or sudden.

Second is the Universal Credit payment history. Tenants are entitled to see what housing costs have been paid on their behalf. This information can usually be accessed through the Universal Credit journal or by requesting a payment breakdown. If UC has been paying the full rent while the tenant was also paying extra, that raises serious questions that may need formal investigation.

Third is affordability. Universal Credit taper rules mean that when earnings increase, support is gradually reduced, sometimes leaving people worse off in the short term. This is known as the “cliff edge” problem. People can end up earning more on paper but struggling far more in reality, especially when housing costs are high.

Importantly, quitting a job to earn less is rarely the best long-term solution, even though it can feel like the only way to survive. Instead, experts usually advise getting clear written evidence first. That means checking the tenancy agreement, requesting a full Universal Credit payment history, and asking the landlord to explain — in writing — how the rent figure has changed and why.

If the landlord cannot justify the increase properly, the tenant may be able to challenge it. Advice services such as Citizens Advice or local housing charities can help tenants understand their rights and, if necessary, take action to prevent unlawful rent increases or recover overpaid rent.

This case highlights a harsh reality facing many working families: employment does not always guarantee security. When benefits are withdrawn and rents rise at the same time, people can quickly find themselves worse off despite doing “the right thing”.

For anyone in a similar position, the most important steps are to gather evidence, seek advice early, and not assume the landlord’s word is final. Rent, benefits, and housing rights are governed by rules — and knowing those rules can make the difference between stability and crisis.

Leave a comment