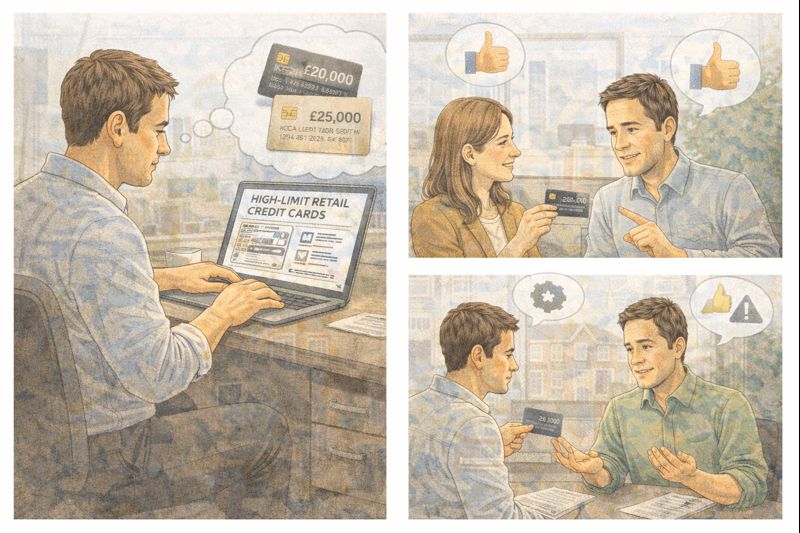

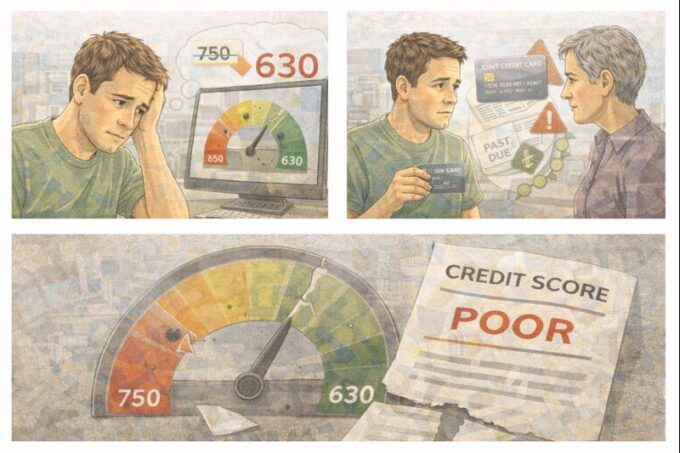

Many people trying to rebuild or improve their credit run into the same problem: their credit score isn’t terrible, but their available credit is too low. That keeps their utilisation ratio high, which drags their score down even more. To fix this, some people look to retail credit cards, which are often easier to get than standard bank cards and can sometimes come with surprisingly high limits.

That’s the situation one borrower recently shared. With a FICO score around 640–655, they weren’t looking to spend more money. Their goal was simple: increase available credit to lower utilisation. They already had some success. A card through a carpet retailer came with a £5,000 limit. A Lowe’s card gave £7,000, and Home Depot approved £4,000. Based on those results, they wanted to know where else to look.

They asked whether furniture stores, electronics retailers, or other big-name shops might offer similar limits — ideally without going through Synchrony Bank, which they wanted to avoid.

Their question sparked a familiar discussion among people in similar credit ranges. The general response was that yes, some retail cards can give higher limits, but it depends heavily on the type of store, the ticket size of what they sell, and how the lender views risk.

People pointed out that big-ticket retailers are usually more generous. Stores that sell furniture, appliances, electronics, or home improvement items expect customers to finance large purchases. Because of that, they often approve higher limits than clothing or small retail shops.

Electronics retailers like **Best Buy** are frequently mentioned. Some borrowers with mid-600 scores reported getting limits in the £3,000–£6,000 range, especially if income is stable. Furniture stores can be similar, particularly chains that sell full living room or bedroom sets. These stores often run their own financing programs and are used to approving larger amounts.

Department stores also came up in the discussion. Cards from places like **Macy’s** or **Kohl’s** don’t always start huge, but they are known for offering credit limit increases fairly easily over time if the card is used and paid off properly.

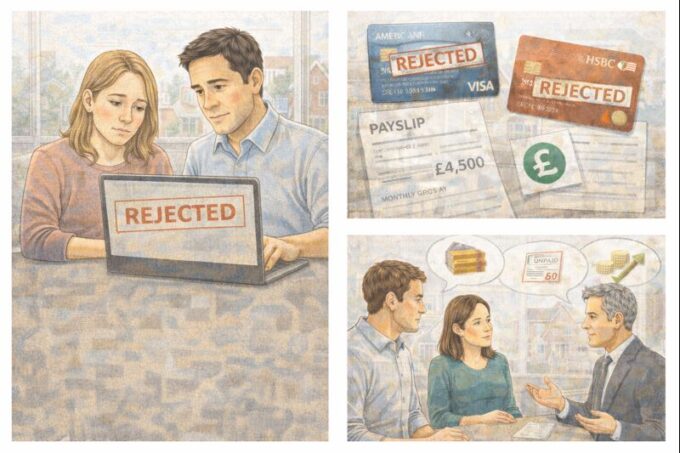

One important point people stressed is that pre-approval tools can be misleading. A card may look “easy” to get, but the actual limit depends on income, existing debt, and recent credit activity. Two people with the same score can get very different results.

Others warned that opening too many retail cards too quickly can backfire. While more available credit lowers utilisation, multiple hard credit checks in a short time can temporarily hurt scores. Spacing applications out and keeping balances very low is usually the safer approach.

Another key reminder was interest rates. Retail cards often have very high APRs. They are useful tools for utilisation, but only if balances are paid off in full. Carrying debt on them can quickly undo any credit score gains.

Several commenters suggested an alternative approach: instead of opening many new retail cards, ask for credit limit increases on existing ones after six to twelve months of good history. Home improvement cards, in particular, are known for generous increases when accounts are well-managed.

In simple terms, the discussion boiled down to this. Yes, retail cards can help boost available credit, even with a mid-600 score. The best chances usually come from big-ticket retailers like home improvement, electronics, and furniture stores. But they should be used carefully, slowly, and with a clear plan.

For anyone in a similar position, the most realistic strategy is a mix of patience and restraint: apply selectively, keep balances low, pay on time every month, and let credit limits grow naturally. Used wisely, retail cards can be a stepping stone to stronger credit — not a trap.

Leave a comment