Getting rejected for credit cards in the UK can feel confusing and discouraging, especially when you believe you are doing everything right. Many people assume that having a good salary, stable work, and paying bills on time should automatically open doors to credit. When that does not happen, it can feel like the system is broken or unfair. In reality, the problem is usually not income or responsibility, but a lack of visible UK credit history.

This situation affects a lot of people who move to the UK from abroad, even if they have lived and worked here for a couple of years. Credit in the UK works very differently from banking, and that difference is often not explained clearly. Banks and lenders are not just looking at how much money you earn or whether you have a bank account. They are looking for proof that you have borrowed money in the UK system before and paid it back reliably over time.

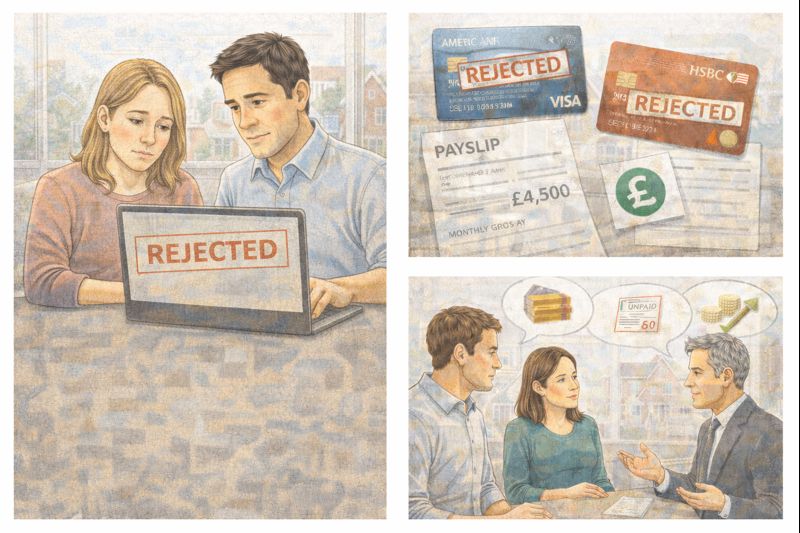

The person in this situation explained that they have lived in the UK for just over two years. Their salary is above average and their job is stable. For most of the last seven years, they have used Wise for everyday banking. They also have a Barclays account, but they mainly use it to pay their mobile phone bill because their phone provider does not accept Wise cards. From their point of view, they are managing money responsibly and doing nothing wrong.

Things became frustrating when they tried to apply for credit. A friend with excellent credit sent them an Amex referral link, but their Amex applications were automatically declined. They then tried applying for a credit card with HSBC in branch and were declined again. When they checked their Experian credit report, they saw a score of 780 out of 1250, which looked reasonably good. That made the rejections feel even more confusing.

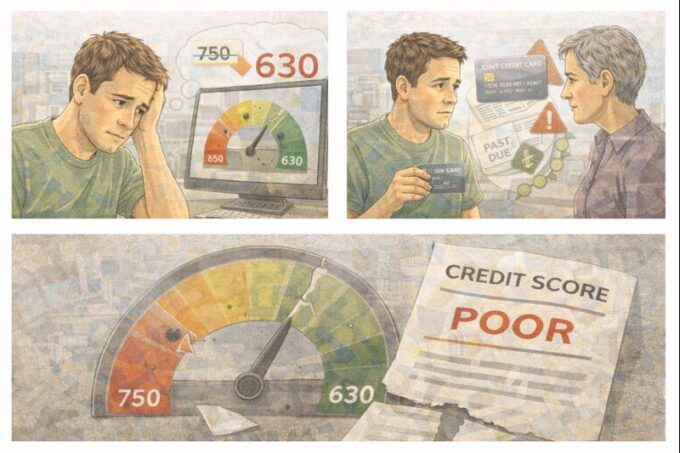

What is happening here is a classic example of a thin UK credit file. A credit score number on its own does not mean much. Lenders care far more about what is behind the number. In this case, there is very little UK credit activity for lenders to assess. Using Wise does not help build UK credit history because Wise does not report day to day spending or balances to UK credit reference agencies. From a lender’s point of view, it is almost as if that activity does not exist.

Paying a mobile phone bill helps a little, but one bill on its own is not enough. Lenders want to see a pattern of borrowing and repayment. They want to see that you can use credit, manage it sensibly, and pay it back month after month. Without that, even a good salary does not reduce the risk enough for them to say yes.

American Express is especially cautious in the UK. Amex likes applicants who already have a clear and established UK credit history. Referral links do not override that. HSBC and other high street banks can also be conservative, especially when they do not see enough UK credit data to feel confident.

The good news is that this situation is very fixable, but it requires patience and a change in approach. The first important step is to accept that building UK credit history is a slow process. There is no shortcut that works reliably. The goal is to show lenders that you are a safe borrower over time, not to convince them in one application.

One of the most helpful things to do is to make a UK bank account your main account for everyday life. This means having your salary paid into it, using it for spending, and having regular bills and direct debits coming out of it. This does not directly create credit history, but it helps lenders see a stable and normal financial picture when they check your details.

Another very important step is registering on the electoral roll at your current address. This is one of the simplest ways to improve how lenders see you. Being on the electoral roll helps them confirm your identity and address history. Many people overlook this, especially if they have moved recently or are not originally from the UK, but it can make a real difference.

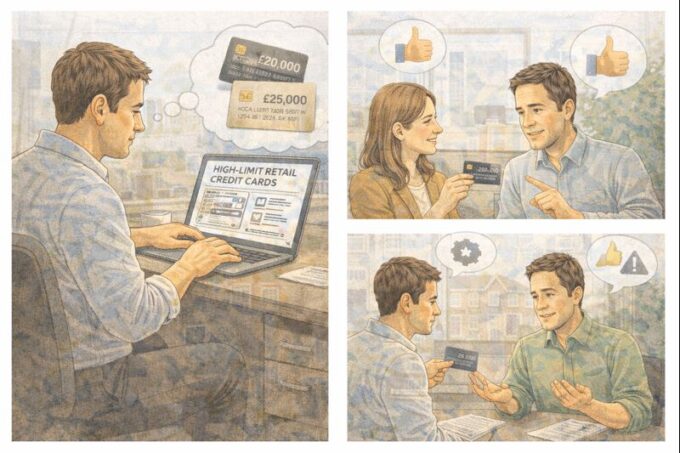

To actually build credit history, you usually need to start small. This often means using a starter credit card, even if it does not feel exciting. Cards aimed at people with limited or no credit history exist for this exact reason. They often come with low limits and high interest rates, but the interest rate does not matter if you pay the balance off in full every month.

Using a starter card properly is more important than the type of card itself. The best approach is to spend a small amount each month, let the statement generate, and then pay it off in full before the due date. This shows lenders that you can borrow and repay responsibly. Doing this consistently for six to twelve months builds the kind of history that mainstream lenders want to see.

It is also very important to avoid applying for multiple cards in a short period. Each rejection makes things harder because it leaves a mark on your credit file. Instead of full applications, eligibility checkers should be used wherever possible. These checks do not damage your credit and give a better idea of whether you are likely to be accepted.

If you rent your home, you may also be able to report your rent payments to credit reference agencies. This does not replace credit card history, but it can strengthen your overall profile by showing regular, on time payments for a major expense.

Throughout this process, consistency matters more than speed. Paying everything on time, keeping balances low, and avoiding financial surprises all help. Credit history is about trust built slowly. Lenders want to see calm, predictable behaviour over time.

If your long term goal is getting an Amex and eventually a mortgage, think of this as laying foundations. For the first few months, the focus should be on building a basic UK credit footprint. After six months of clean history, eligibility for mainstream cards often improves. After a year, options open up much more.

For a mortgage, lenders will also look at income, savings, stability, and affordability. Credit history is just one part of the picture, but it is an important one. Building it carefully now makes everything easier later.

The frustration in this situation is understandable. It feels unfair to be rejected when you are working hard and managing money responsibly. But the system is not judging effort or income. It is judging familiarity and evidence. Once you understand that, the path forward becomes clearer.

Start small, stay patient, avoid rushing applications, and focus on building a quiet, boring, reliable credit history. That is what UK lenders trust, and over time, it does work.

Leave a comment