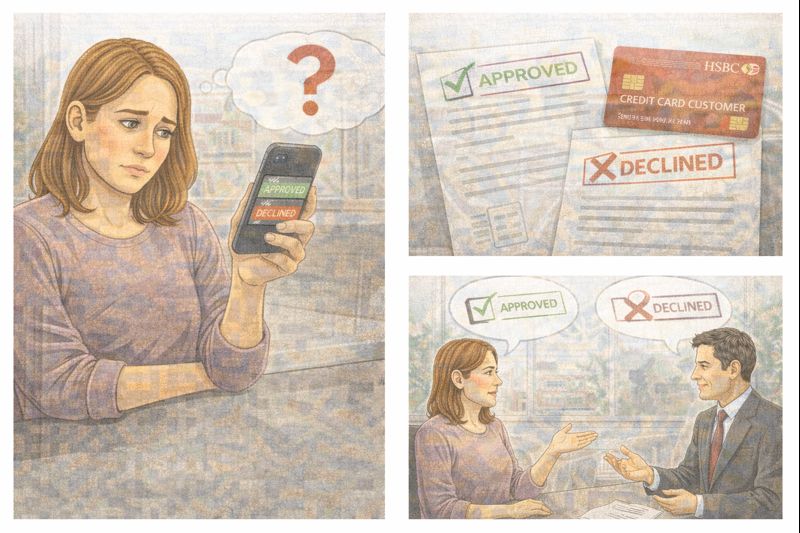

Dealing with credit cards can be stressful, especially when health, work, or life problems have already made things difficult. Many people do not fully understand how credit card reviews, reassessments, or eligibility decisions work, and when something goes wrong or takes too long, it can create a lot of anxiety.

In this situation, the person explained that they have been dealing with long-term illness and had to leave their job. Because of that, their finances changed, and they have been relying more on credit to get by. They already had a credit card and were on a basic level for a long time, but later realised that they may have been eligible for better support from the bank, such as reduced payments, interest relief, or a different account status.

While looking through old messages and account notes, they found a letter from a few years ago saying they had been approved for a more supportive credit card arrangement. When they contacted the bank to ask about it, they were told the letter had been sent by mistake and that their account was actually set up differently. This caused a lot of confusion and frustration, because it felt like mixed messages and lost time.

Because of that, they asked for a fresh review of their credit card account. They sent in new information about their situation and waited a very long time for the bank to reassess things. After around 18 months of waiting, they finally had a phone review earlier this week. Now they are worried about how long it will take to get a final decision and whether they might be entitled to any refund or adjustment if the bank agrees they should have been on better terms earlier.

These worries are very understandable. Long delays make people anxious, especially when money is tight and answers feel overdue.

In most cases, after a credit card review or reassessment, banks take a few weeks to make a decision. It is usually quicker than the wait for the review itself, even though it may not feel that way after such a long process. Many people hear back within two to six weeks, depending on how complex the case is and how busy the bank is.

If the bank decides that the customer should have been given better support earlier, there can sometimes be refunds. This might include refunded interest, reduced charges, or adjustments to the balance. Any refund usually depends on when the bank believes the change should have applied, not just when the review took place. That means dates, records, and previous communication all matter.

Because the earlier letter was described as a mistake, it does not automatically mean a refund from that time. However, if the bank accepts that there were errors, delays, or poor handling of the account, they may still offer compensation or corrections. This is why it is important to ask for a clear explanation in writing once the decision is made.

For people in similar situations, there are a few helpful steps. Keeping copies of all letters, emails, and notes from phone calls can make a big difference. Checking statements carefully can help you understand what interest or charges were added over time. If the outcome feels wrong or unclear, you can ask the bank to explain how they reached their decision.

If someone is unhappy with the result of a credit card review, they usually have the right to complain and ask for a further review. If that still does not resolve things, the case can sometimes be taken to the Financial Ombudsman, who can look at whether the bank acted fairly.

While waiting for a decision, it can help to remember that completing the review is an important step forward. Even though the process feels slow and exhausting, many people do eventually get clearer answers and better support once the assessment is finished.

Credit card systems can feel cold and confusing, especially when health or work issues are involved. But asking questions, requesting reviews, and checking past decisions are reasonable things to do. For now, the best approach is to wait for the bank’s response, read it carefully, and then decide the next step based on what they say.

Leave a comment