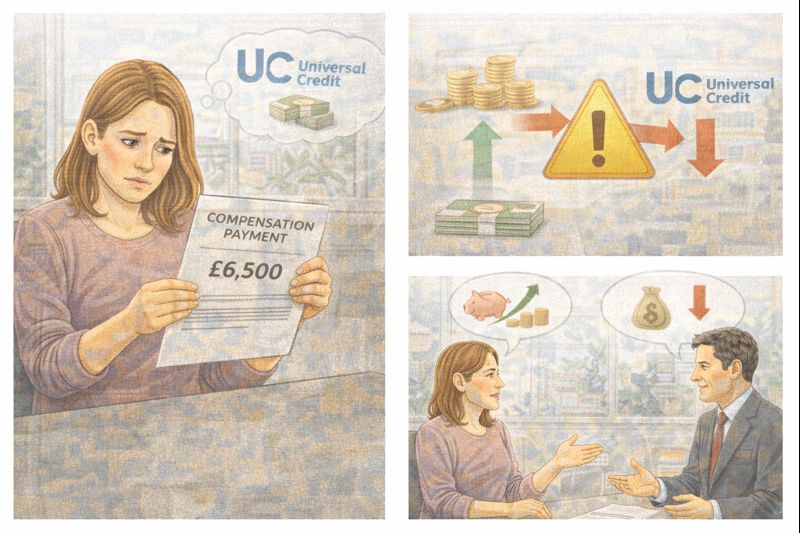

For many people on Universal Credit, especially those in the LCWRA group, the idea of receiving a compensation payment can be stressful rather than reassuring. Instead of feeling relief, people often worry that the money will push them over the savings limits and cause their benefit payments to be reduced or stopped completely. This worry is understandable because Universal Credit has strict rules around capital, and the system is not always explained clearly.

The question usually comes up when someone is expecting compensation linked to things like medical negligence, a GDPR failure, or criminal injury. These payments are often meant to support recovery, future care, or long-term health needs. Losing benefits because of that money can feel unfair, especially when the compensation is not meant for day-to-day living costs.

In this situation, the person wanted to know whether compensation payments are ignored when Universal Credit looks at savings, particularly when savings go over £6,000 or £16,000. They also wanted to understand whether putting the money into a trust for future healthcare and respite would protect it from being counted as personal savings.

The rules do allow for compensation to be treated differently, but only if things are done carefully.

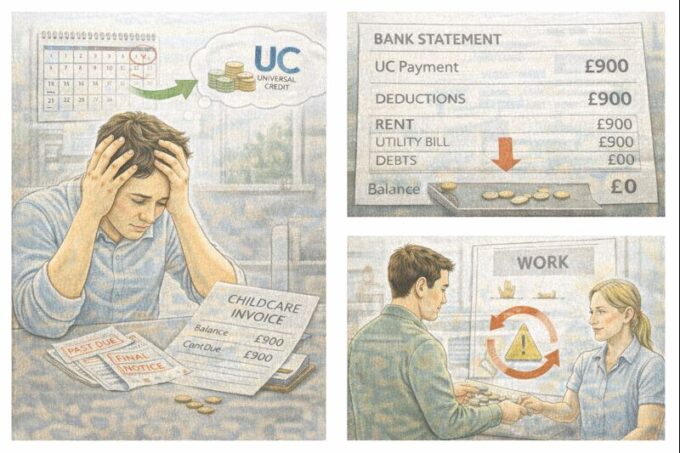

Under Universal Credit rules, some types of compensation are disregarded as capital. This includes compensation for personal injury, medical negligence, and criminal injuries. When this type of payment is received, Universal Credit usually ignores it for the first 12 months. During this period, it does not matter how large the payment is. Even if it takes savings well over £16,000, it should not reduce or stop Universal Credit during that time.

However, this protection only applies if the money is clearly identifiable. In simple terms, that means the compensation should be kept separate from normal spending money. If it is paid into a dedicated account and not mixed with wages, benefits, or everyday savings, it is much easier to show that it should be ignored.

After the 12-month period ends, the rules change. If the compensation is still held in the claimant’s own name, Universal Credit will usually start to treat it as normal capital. At that point, savings over £6,000 can reduce monthly payments, and savings over £16,000 can end entitlement altogether. This can come as a shock to people who were not warned about the time limit.

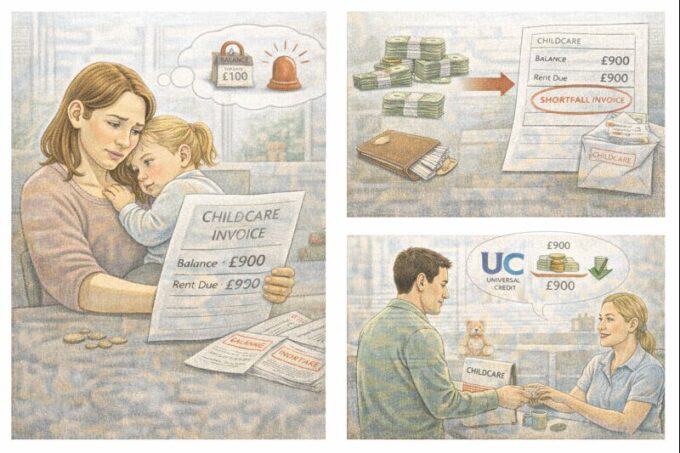

This is where trusts become very important.

A personal injury trust is a legal arrangement where the compensation money is placed under the control of trustees. Although the money is there to benefit the person who received the compensation, it is not legally owned by them. Because of this, Universal Credit normally does not count money held in a properly set-up personal injury trust as personal savings, even after the 12-month disregard period has passed.

For people with long-term health conditions, disabilities, or ongoing care needs, this can be a sensible way to manage compensation. It allows the money to be used for things like therapy, equipment, extra care, transport, or respite, without constantly risking benefit entitlement.

It is important to understand that not all trusts are treated the same way. The trust must be set up correctly and genuinely managed by trustees. Simply putting money into another account or creating an informal arrangement is not enough. If Universal Credit believes the claimant still has full control over the money, or that the trust was created purely to get around benefit rules, they may still count it as personal capital.

Timing also matters. Setting up a trust within the first 12 months of receiving the compensation is usually the safest option. During this period, the money is already disregarded, so moving it into a trust does not usually raise concerns. Waiting too long can make things more complicated and may lead to questions about why the money was not protected earlier.

Another key point is reporting. Even if compensation is disregarded, claimants must still tell Universal Credit about it. This includes explaining what the payment is for and providing evidence if asked. Not reporting a lump sum can lead to problems later, including overpayment decisions or accusations of failing to disclose information.

Many people worry that reporting compensation will automatically trigger a reduction in benefits, but being open and clear is usually the safer option. Universal Credit is more likely to take action if money appears suddenly during a review and has not been explained.

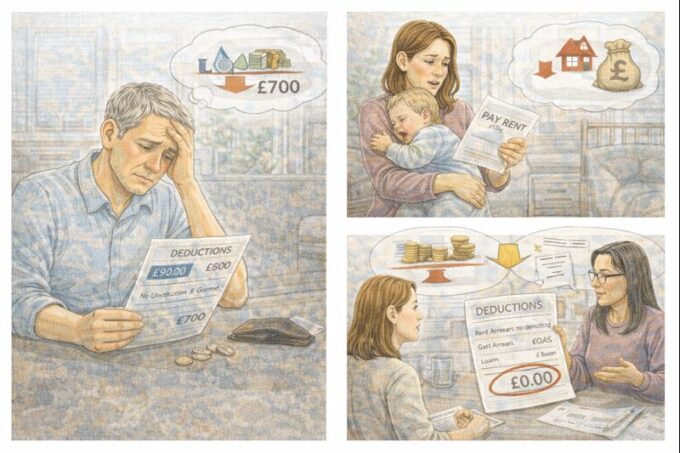

In simple terms, compensation does not automatically mean losing Universal Credit. For the first year, many compensation payments are ignored. After that, a properly set-up personal injury trust can continue to protect the money. Without a trust, the funds may start to affect entitlement once the 12 months are over.

Because the rules are detailed and mistakes can be costly, many people choose to get advice before making decisions. Welfare rights advisers, Citizens Advice, and solicitors who specialise in personal injury trusts can help explain options and make sure everything is done correctly.

For anyone on LCWRA who is expecting compensation, the key things to remember are to keep the money separate, report it honestly, understand the 12-month rule, and get advice early if a trust is being considered. Taking the right steps early can help make sure the money supports health and wellbeing without putting essential benefits at risk.

Leave a comment