For many people in the UK, claiming Universal Credit does not begin with support. It begins with waiting. And that wait often comes at the worst possible time.

Most people do not apply for Universal Credit because life is going well. They apply because something has already gone wrong. A job has ended. Hours have been cut. Illness has made work impossible. A relationship has broken down. Rent still needs to be paid, food still needs to be bought, and bills do not pause just because a benefit claim has started.

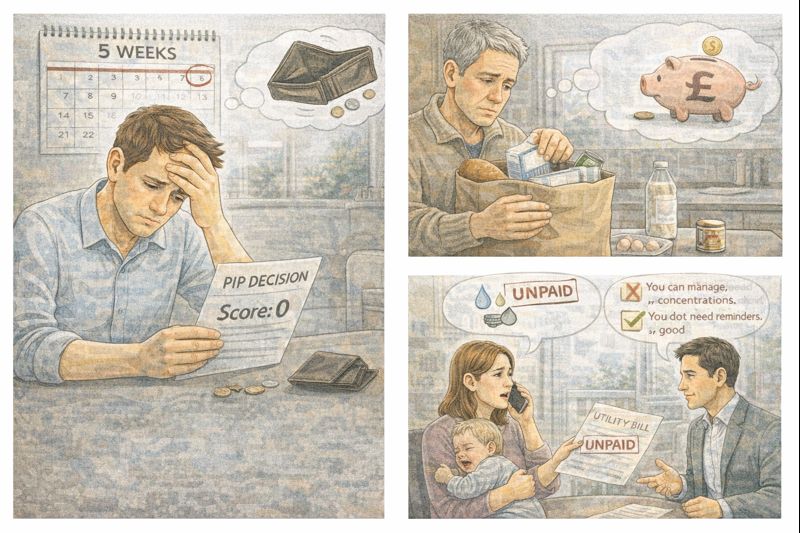

Yet under the Universal Credit system, most new claimants must wait around five weeks before receiving their first payment. During this time, there is usually no regular income at all. For households with little or no savings, this gap is not just difficult. It can be devastating.

The five-week wait has become one of the most criticised parts of Universal Credit because of the real harm it causes. People fall into debt before their first payment even arrives. Rent arrears build quickly. Anxiety and stress increase. In many cases, the problems created during this waiting period continue long after the first payment is made.

The reason this happens is not usually because of mistakes or delays. It is built into how Universal Credit works.

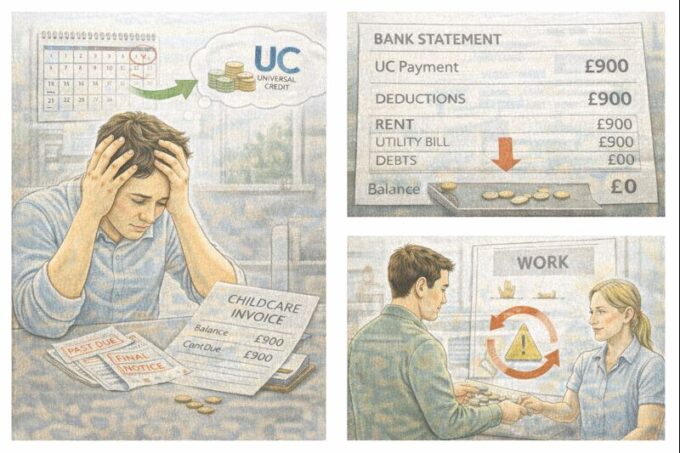

Universal Credit is paid monthly and in arrears. This means the system looks at your circumstances over a full month, called an assessment period. Only after that month ends does payment get processed, which usually takes another week. Even if everything goes smoothly, this creates a gap of around five weeks.

For someone moving straight from work to benefits, this can mean they are expected to survive for over a month with no wages and no benefit. Final wages may already have been spent on rent or bills. Savings may be small or non-existent. There is often no financial cushion at all.

The impact is especially severe for certain groups. Single parents, disabled people, people leaving abusive relationships, those with health conditions, and renters with strict payment schedules are among those most affected. Many of these claimants are already under emotional strain when they apply. The lack of income during the waiting period often pushes them into crisis very quickly.

In real life, the consequences show up fast. People borrow money from family or friends just to get through the first few weeks. Others rely on credit cards or overdrafts, knowing this will create problems later. Some turn to high-cost lenders out of desperation. By the time the first Universal Credit payment arrives, debt has already taken hold.

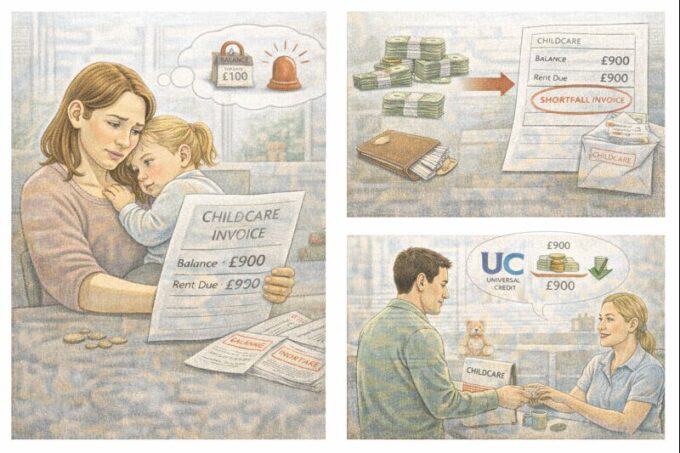

Rent is one of the biggest pressures. Because housing costs are included in Universal Credit rather than paid separately, missing one month often means falling behind straight away. Once rent arrears start, they can be extremely hard to clear, especially if future Universal Credit payments are already reduced by deductions.

Food insecurity is another common result. Many people use food banks during the waiting period. Some skip meals so children can eat. Others ration heating or electricity to save money. These are not rare cases. They are common experiences reported across the country.

The emotional toll should not be underestimated. Living for weeks with no money creates constant worry. People describe feeling ashamed, frightened, and overwhelmed. For those with existing mental health conditions, the stress can make symptoms much worse. Even for people who have never struggled with anxiety before, the uncertainty can be deeply distressing.

To deal with the five-week wait, Universal Credit offers an Advance Payment. This is often presented as a solution, but it comes with serious consequences that are not always fully understood at the time.

An advance is essentially a loan from future Universal Credit payments. It can usually be paid quickly, which makes it attractive when there is no money for food or rent. For many people, refusing an advance is simply not realistic. They need money immediately to survive.

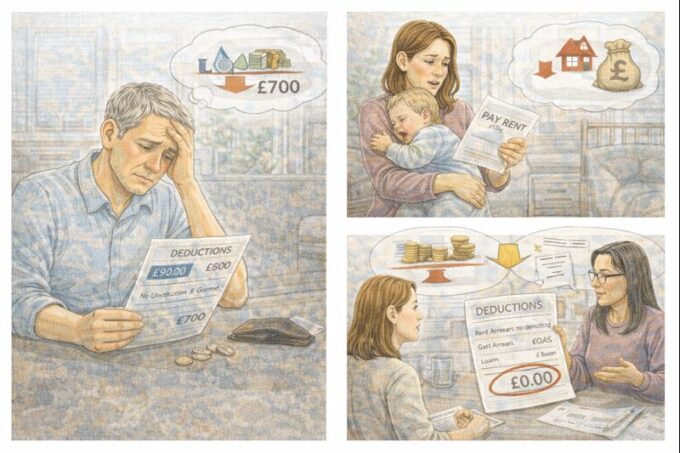

However, the advance must be paid back. Repayments are taken automatically from future Universal Credit payments, often over many months. This means that even after the waiting period ends, people receive less than their full entitlement each month.

For some households, these deductions make budgeting extremely difficult. The original crisis caused by the five-week wait does not disappear. It is spread out over time, reducing income month after month. In effect, the system shifts the hardship forward rather than removing it.

There are steps claimants can take to reduce the damage, even though the system itself is the root of the problem.

Applying for Universal Credit as early as possible is crucial. The assessment period starts from the date the claim is made, not from when income stopped. Delaying a claim only pushes the first payment further away.

If an advance is needed, it is important to understand the repayment terms. Claimants can ask for the smallest amount they can realistically manage and request the longest possible repayment period to reduce monthly deductions. This does not remove the problem, but it can make it more manageable.

Speaking to landlords early can also help. Some landlords are more flexible when they understand that Universal Credit is pending. Early communication can sometimes prevent eviction action or allow temporary arrangements to be made.

Seeking local support immediately is another key step. Many councils and charities offer short-term help such as food vouchers, emergency grants, council tax support, or discretionary housing payments. These supports are often time-limited and easier to access early rather than after debt has built up.

It is also important for claimants to know that struggling during the five-week wait is not a personal failure. The system was designed this way, and many experts agree it does not reflect how people actually live.

Charities and advice organisations have repeatedly called for changes, such as non-repayable starter payments, shorter waiting periods for new claims, or grants instead of loans. Until such reforms are made, the five-week wait will continue to be one of the biggest drivers of hardship within Universal Credit.

For anyone facing this situation now, the most important thing is not to suffer in silence. Apply early, ask questions, seek advice, and reach out for support. The wait is real, the pressure is real, and the need for help during this period is completely valid.

Leave a comment