For many people, turning 18 is exciting. It feels like the start of independence. But when it comes to money and credit, it’s also a time when mistakes can happen very easily — often without fully understanding the consequences. Credit cards, credit scores, and shared accounts are rarely explained properly, and young people often trust parents or older relatives to guide them the right way.

That trust is what makes situations like this so painful.

The young person involved explained that when they turned 18 in 2022, their dad took them to a local credit union and helped them open a credit card. At the time, they didn’t really understand what they were signing. They believed they were just being added to their dad’s card as an authorised user, meaning they could build credit but wouldn’t be responsible for the debt.

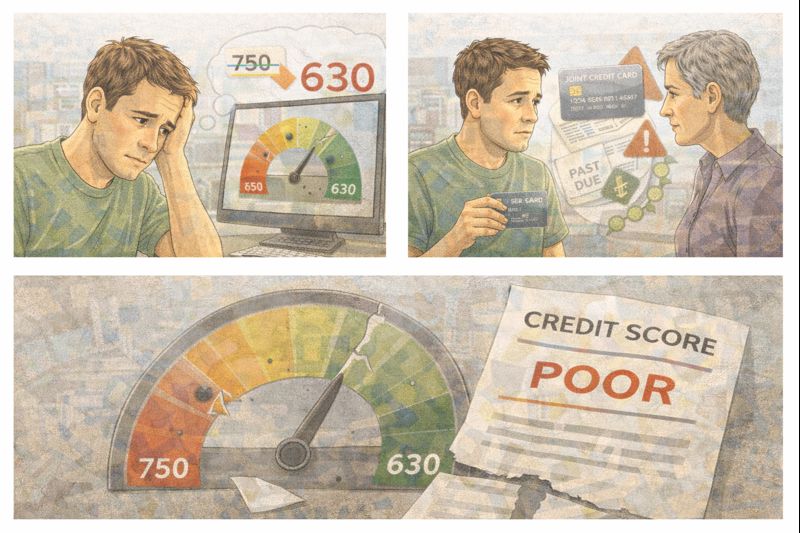

For a while, everything looked great. Their credit score climbed to around 750. Last year, they even opened their own personal credit card with no issues. They felt like they were doing well and starting adult life on the right foot.

Then came the shock.

When they checked their credit score recently, it had dropped to around 630. At first, they were confused and devastated. After looking closer, they discovered the real problem: their dad had almost maxed out the shared credit card and had stopped paying it down properly. Even though they hadn’t used the card since October and had paid off their own spending, the balance was still showing up on their credit report.

The reason is simple but brutal. The account wasn’t just an authorised user card. It was a joint credit card. That means both names on the account are fully responsible for the debt, no matter who spent the money.

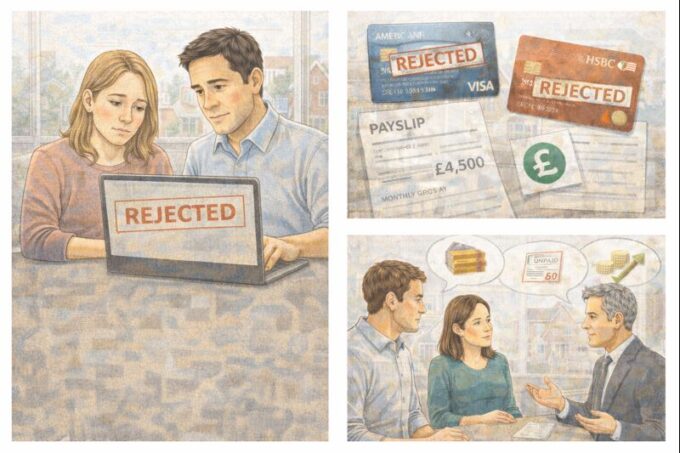

The situation got worse when they realised their dad wasn’t planning to pay the balance off anytime soon. He told them it would take at least four months. Meanwhile, they are planning to move in May and need to apply for apartments soon. A credit score in the low 600s could mean higher deposits, rejections, or fewer options.

They contacted the credit union, hoping to be removed from the account. The answer was crushing. Because it is a joint account, they cannot be removed unless the balance is paid in full. Disputing it through a credit app didn’t help either, because the information is technically accurate. The bank sees two names, one balance, and shared responsibility.

Emotionally, the situation hit hard. They felt angry, betrayed, and helpless. Paying the balance themselves feels unfair, especially since they don’t trust their dad to pay them back. At the same time, waiting months for him to fix it could cost them housing opportunities.

The discussion around this situation brought up some important realities that many people don’t learn until it’s too late.

First, joint credit cards are dangerous unless there is absolute trust. They are not training tools. They are full legal agreements. If one person spends, both people pay. Credit bureaus don’t care who caused the debt — they only care that it exists.

Second, credit score apps can cause extra panic. They are useful for monitoring trends, but they are not official decision-makers. What really matters is what shows on official credit reports and how lenders view the risk.

Third, there is no fast or painless fix. Legal action against a parent is emotionally heavy and slow. It won’t repair a credit score in time for an apartment search. Disputes don’t work when the debt is real and correctly reported.

So what can someone in this position realistically do?

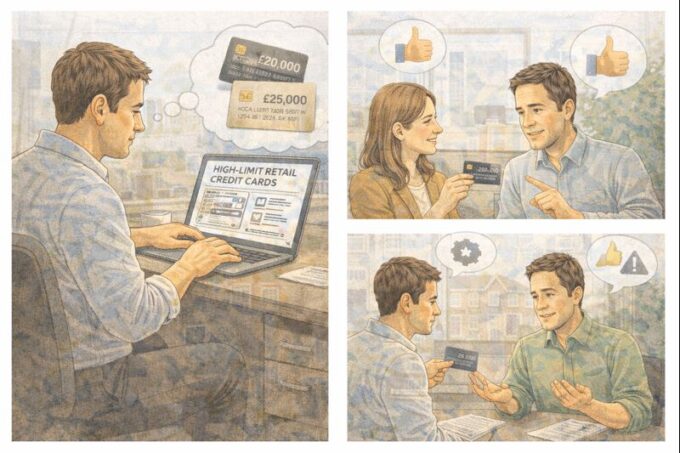

The first step is to protect future damage. That means stopping all new spending on the joint card if possible and making sure the personal credit card is kept at a very low balance. Even one card used well can help a score recover over time.

The second step is to focus on utilisation. Credit scores are very sensitive to how much of the available credit is being used. Even paying down part of the balance on the joint card can help improve the score, even if it feels unfair.

The third step is communication — not just with the parent, but with landlords. Some landlords care more about income and rental history than a single score. Being upfront and showing proof of on-time payments can sometimes make a difference.

Finally, this situation is a hard lesson that many young adults learn the painful way. Never sign a joint credit account unless you are prepared to be fully responsible for everything that happens on it. Even family can make financial choices that hurt you.

The good news is that at this age, credit can recover. Scores are not permanent labels. With time, low balances, and on-time payments, improvement is possible. But the experience leaves a lasting message: credit is personal, and once it’s shared, control is lost.

For anyone just starting out, this story is a warning worth hearing early.

Leave a comment