A common financial crossroads is facing many people in their forties: should spare money be used to clear the mortgage faster, or should it be invested in the stock market for potential higher returns? On the surface, it looks like a maths problem. In reality, it’s a balance between risk, security, flexibility, and peace of mind.

In this case, the individual is 46 years old, earning around £41,000 a year with an additional £4,000 annual bonus. They have built a solid financial base: £38,000 in savings, £3,000 in an investment ISA, and a £44,000 pension pot. Their home is worth roughly £200,000, with two mortgages totalling £104,000. Monthly outgoings are about £1,700, leaving £1,200 of spare cash each month after bills and food. They already overpay both mortgages to the maximum allowed.

On paper, this is a strong position to be in. The real question is how to use that position most wisely over the next 15 to 25 years.

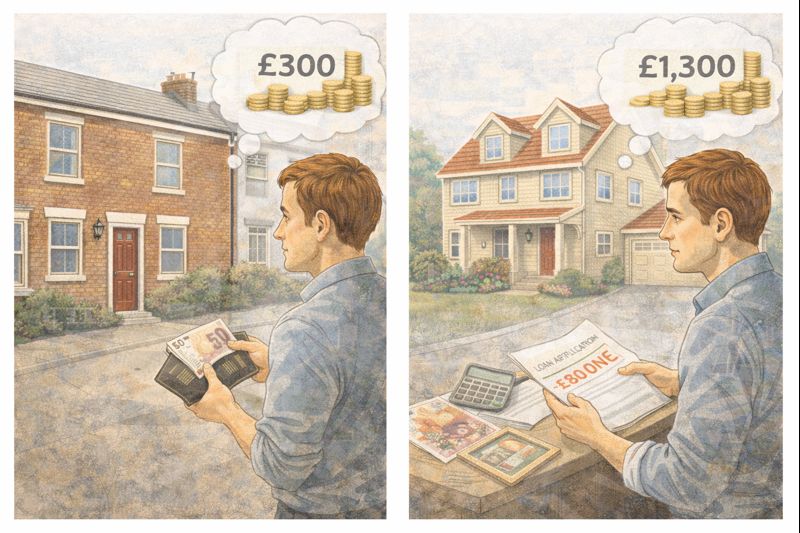

Paying down a mortgage offers something few investments can: a guaranteed return. Every pound used to reduce the mortgage balance avoids future interest. That saving is certain, tax-free, and not affected by market crashes. For many people, especially after divorce or major life changes, the emotional benefit of owning more of their home outright is significant. Lower debt means lower stress, fewer monthly obligations, and greater resilience if income drops.

In this situation, using a chunk of the £38,000 savings to clear one of the mortgages would immediately reduce monthly costs. That extra cash flow could then be redirected into investments each month, creating a steady investing habit without market timing pressure. Psychologically, this approach often helps people stay invested long term because they feel more secure at home.

However, there is a trade-off. Money locked into a house is illiquid. Once it’s paid into the mortgage, it’s not easily accessible without remortgaging or selling. If that £38,000 represents most of the emergency buffer, paying it all into the mortgage could reduce financial flexibility. For someone still in their working years, maintaining a healthy cash reserve is important.

On the other side is investing in stocks, typically through ISAs or pensions. Historically, long-term stock market returns have beaten mortgage interest rates, especially over 15 to 20 years. At 46, there is still time for compound growth to work, particularly if investments are diversified and held through market ups and downs.

The risk, of course, is volatility. Investments can fall sharply in the short term. Unlike mortgage overpayments, returns are not guaranteed. But with £1,200 spare each month, regular investing smooths that risk over time. Investing monthly also avoids the pressure of choosing the “right” moment to enter the market.

Another important factor here is the pension. With £44,000 currently saved, pension growth should not be ignored. Pension contributions benefit from tax relief, which is effectively an immediate return that beats almost any mortgage interest rate. Increasing pension contributions, especially using the £4,000 bonus, could significantly improve long-term retirement outcomes.

The decision is also influenced by age. At 46, the focus often starts to shift from aggressive growth to balance. That doesn’t mean avoiding risk entirely, but it does mean prioritising stability alongside growth. Clearing mortgage debt before retirement reduces the amount of income needed later, which lowers pressure on investments.

Many financial planners would suggest that this doesn’t have to be an either-or choice. A blended approach often works best. Keeping a solid emergency fund, using part of the savings to reduce mortgage debt, and steadily increasing investments at the same time spreads both risk and reward.

For example, retaining six months’ worth of expenses in cash protects against job loss or unexpected costs. Any excess savings beyond that could be used to clear the smaller mortgage or significantly reduce one balance. The freed-up monthly cash flow could then be split between ISAs and pensions, maintaining flexibility and growth.

It’s also worth looking at mortgage interest rates. If either mortgage has a relatively high rate, overpaying that one first makes more sense. Paying down high-interest debt is effectively a risk-free investment. Lower-rate mortgages make investing more attractive by comparison.

Ultimately, the “best” choice depends less on spreadsheets and more on personal comfort with risk. Some people sleep better knowing their mortgage balance is falling quickly. Others are comfortable with market swings and prefer maximising long-term growth. Neither approach is wrong.

What stands out here is that the individual already has strong habits: overpaying debt, maintaining savings, and starting to invest. The real win will come from consistency rather than one perfect decision. Whether through reduced debt or growing investments, the key is using surplus money deliberately rather than letting it sit idle.

In simple terms, if peace of mind and lower monthly obligations matter most, paying off one mortgage makes sense. If long-term growth and maximising returns matter more, increasing investments, especially pensions, is compelling. For many in this position, doing some of both is the smartest and most sustainable path forward.

Leave a comment