For many parents, the months near the end of maternity leave are filled with difficult questions. But few decisions are as complex as choosing between a secure, well-paid job and a large redundancy payout that offers freedom, time, and breathing space. When you add childcare costs, an unemployed partner, and the long-term impact on pensions and mortgages, the choice becomes less about money alone and more about risk, timing, and what kind of life you want in the next few years.

On paper, this is a strong position to be in. A £40,000 salary with annual rises, flexible working, generous leave, and a defined benefit pension with a 29% employer contribution is something many people would never walk away from lightly. Add a supportive manager and the ability to work from home most of the week, and it becomes what many would describe as a “golden handcuffs” role. Comfortable, stable, and hard to replace.

At the same time, a redundancy payout of £50,000 to £55,000 is not trivial. That amount represents years of take-home pay for many families. Combined with £260,000 already sitting in savings, it creates an unusual level of financial safety — at least in the short to medium term. Few people have the option to step away from work for several years without immediate financial pressure.

Childcare is a major driver in this decision, and rightly so. In London, full-time nursery fees can easily absorb a large part of take-home pay. When you factor in the physical and mental toll of drop-offs, pick-ups, disrupted sleep, and returning to a job you do not enjoy, the value of staying in work becomes less obvious. The reality for many parents is that returning to work can feel like paying someone else to raise your child while you exhaust yourself maintaining a role that no longer fits.

There is also the emotional risk you’ve identified, and it’s an important one. Returning after maternity leave only to realise the job has changed, your priorities have shifted, or childcare makes the whole arrangement feel pointless is incredibly common. Leaving later, without a redundancy payout, would feel far worse than leaving now with a financial cushion. That “now or never” aspect is what makes this decision so heavy.

However, the risks on the other side are real and should not be minimised.

The job you currently have is not just a salary. It is long-term security. Defined benefit pensions are increasingly rare, and a 29% employer contribution is extraordinarily valuable over time. Walking away from that, even for a few years, has a compounding cost that doesn’t show up immediately. You are also giving up predictable income at a time when your household already relies on one earner.

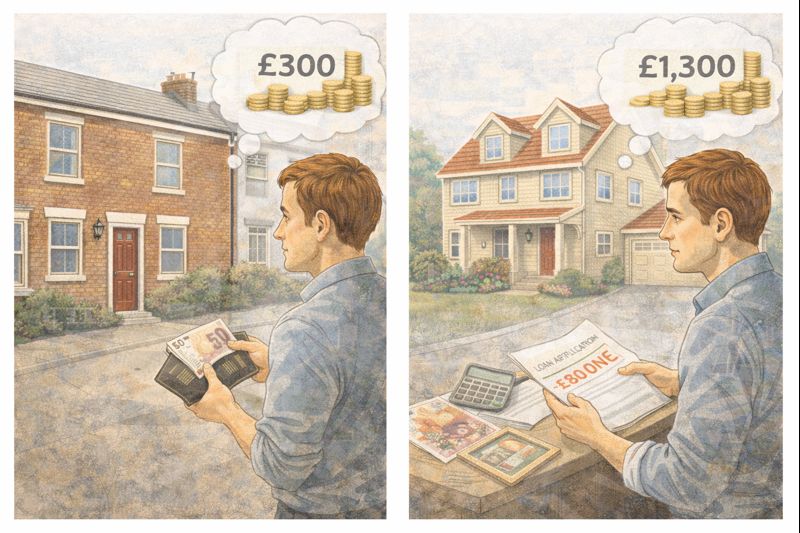

Your husband’s unemployment is a critical factor. Even with significant savings, becoming a single-income household by choice — or a no-income household if you take redundancy — increases vulnerability. Savings provide comfort, but they also shrink quickly when rent, living costs, and childcare-free time stretch into years rather than months. £260,000 sounds like an enormous sum, but in London, with £1,300 rent and a family to support, it is not “never work again” money.

There is also the mortgage issue. Redundancy, even voluntary, weakens your position with lenders. While savings help, consistent income still matters. If buying a home is an important goal in the next few years, stepping away from employment makes that harder, not easier.

Another subtle risk is employability. You mention that your role is low-skilled and non-specialised. That cuts both ways. It means you could likely find similar work again, but it also means competition is high and salaries are under pressure. Government roles, in particular, are increasingly filled internally. A six-month rule before returning may exist on paper, but the reality of re-entering at the same level and conditions is uncertain.

That said, there is also a risk in staying.

Staying means locking yourself into a life you already know you don’t enjoy, at a time when your identity and priorities are changing. It means betting that your manager stays supportive, that childcare works smoothly, and that you don’t burn out trying to balance everything. It also means turning down a redundancy package that may never be offered again.

This is not really a question of “which option is financially optimal”. It is a question of which risk you are more willing to live with.

Taking redundancy is a bet on flexibility, time with your child, and the belief that you can re-enter work later, even if it looks different. Returning to work is a bet on stability, long-term benefits, and protecting your future earning power and pension.

One way to frame the decision is this: if your husband secured stable employment tomorrow, redundancy would look far less risky. If your savings were lower, returning to work would feel almost unavoidable. Right now, you are in a rare middle ground — financially strong, but with household uncertainty.

Many people in this position choose a hybrid mindset rather than a binary one. They take redundancy, but with a clear runway and rules for themselves. A defined period out of work. A plan for skills, training, or part-time re-entry. A savings threshold that triggers a return to employment. Redundancy then becomes a structured pause, not an open-ended exit.

Others decide that maternity leave is not the time to gamble, especially with a dependent partner. They return to work, absorb the childcare cost for a year or two, and reassess once household income stabilises.

There is no universally correct answer here. But there is one important truth: this decision is not reversible in both directions. You can leave now and struggle to get back to the same role. You cannot come back later and retroactively claim a £55,000 payout.

The question, then, is not just “can we afford this?”, but “which regret would be harder to live with five years from now?”

Leave a comment