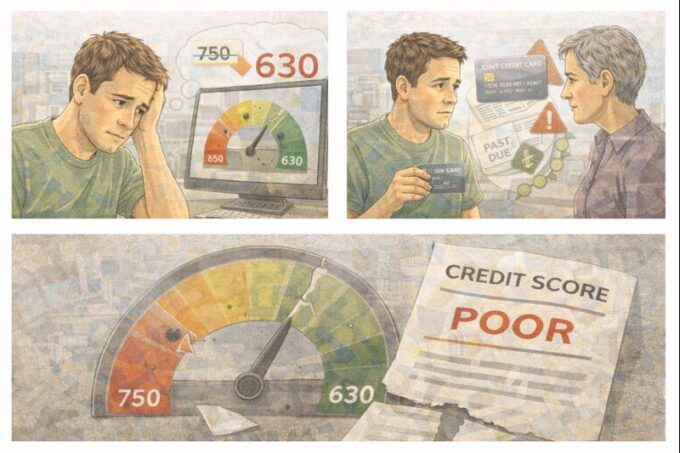

A former London tenant has found herself dealing with the long-term consequences of what appears to be landlord misconduct after discovering a large utility debt had been quietly attached to her name for years, severely damaging her credit score without her knowledge.

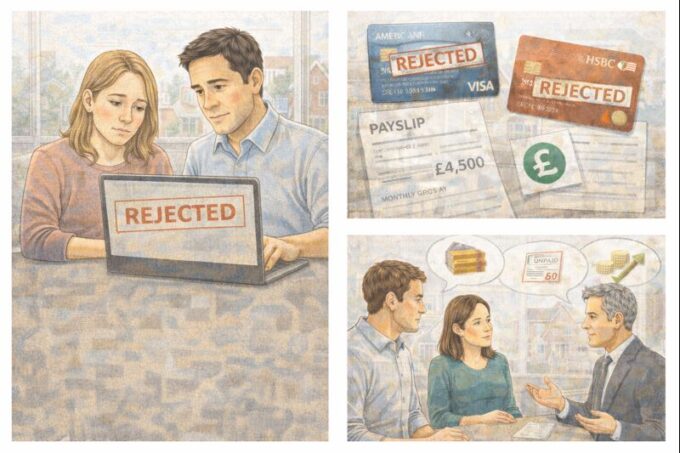

The issue only came to light when she recently checked her credit report to understand why her score was unusually low. Like many renters in their twenties, she assumed the problem was linked to moving frequently, having limited credit history, or not holding a credit card. Instead, she discovered a Thames Water account showing more than £2,000 in unpaid charges dating back to 2020.

The shock was immediate. She had never opened a Thames Water account, never lived alone at that address, and had not even lived in the property since early 2020. Yet the debt had been quietly sitting on her credit file for years, dragging down her score and potentially affecting her future ability to rent, get a mortgage, or access affordable credit.

Back in 2019, she rented a room in a six-bedroom house of multiple occupation in London. She was 21 at the time. Her tenancy agreement was explicit: rent was “all bills included”. This meant utilities, including water, were the responsibility of the landlord, not the tenants. She stayed for around six months and moved out in early 2020.

Her departure was not entirely smooth. A disagreement arose when the landlord expected her to take responsibility for advertising the room on SpareRoom and finding a replacement tenant. She refused, believing this was not her responsibility. Emails from that time show the landlord was unhappy about her decision.

Years later, when examining the debt more closely, she noticed something that made the situation even more disturbing. The water account was not just opened in her name — it was opened using a deliberate misspelling. She has two surnames. The account listed one surname as a “first name” and the other as a “last name”. This meant letters and demands were never addressed correctly, and she was never contacted directly, even though the account was still linked closely enough to appear on her credit report.

This detail has raised serious concerns about intent. The account appears to have been opened after she moved out, suggesting she was never responsible for the water usage being charged. The incorrect name formatting also raises questions about whether the aim was to avoid the debt being easily traced back to her while still shifting liability away from the landlord.

As a result, the debt accumulated quietly. No letters arrived at her address. No phone calls were made. No opportunity was given to challenge the charges early. By the time she became aware of it, the damage had already been done.

She now finds herself in the position many renters fear: having to prove she does not owe money she never agreed to pay, while also repairing a credit record that has been unfairly harmed.

Importantly, she has strong evidence. Her original tenancy agreement clearly states that bills were included. She has proof of the date she moved out, including a new tenancy agreement elsewhere. She also has email correspondence showing the breakdown of the relationship with the landlord at the time she left. Together, these documents form a clear timeline that contradicts the utility account history.

Cases like this are more common than many people realise, particularly in HMOs. Former utility industry workers say rogue landlords account for a significant proportion of unpaid utility debt. When tenants move frequently and do not receive direct bills, debts can be misassigned or deliberately shifted onto individuals who are no longer in a position to notice.

Water companies are legally allowed to open what are known as “deemed” accounts when they believe someone is responsible for a property’s water usage. This is usually based on information from landlords, letting agents, or tracing activity. However, these accounts are not permanent and can be corrected when evidence shows the wrong person was billed.

In situations where a tenancy agreement clearly states bills are included, responsibility usually sits with the landlord or property owner. Once this is confirmed, water companies can reassign the debt and remove it from the tenant entirely.

People who have experienced similar situations say the most effective first step is contacting the utility provider directly and submitting evidence. In many cases, utility companies have been cooperative once the facts are laid out clearly. Some tenants report that not only was the debt removed, but the negative credit information was fully erased rather than marked as settled.

This distinction is crucial. A settled debt still affects credit history. A removed debt restores it.

There is often confusion about whether situations like this should be reported as identity theft. While the experience feels deeply personal, the legal position can be frustrating. In many cases, the official “victim” of the fraud is considered to be the utility company, not the individual whose name was misused. This can make reporting the matter to Action Fraud or the police complicated.

That said, the lack of a criminal report does not prevent the debt being challenged or credit files being corrected. The priority for affected tenants is not prosecution, but restoration — clearing their name, removing the debt, and repairing their credit.

Credit experts advise that once the utility company confirms the account does not belong to the tenant, the individual should contact all credit reference agencies to dispute the entry. With confirmation in writing, agencies can delete the record entirely. In some cases, credit scores recover within weeks.

There is also the option of escalating the issue if the utility provider does not cooperate. Formal complaints processes exist, and unresolved disputes can be taken to the relevant ombudsman. These bodies can order corrections and, in some cases, compensation for distress and inconvenience.

For renters, this case highlights an uncomfortable reality. “All bills included” arrangements depend heavily on landlord honesty. Tenants rarely see utility accounts and may not know if anything has been set up in their name until years later. By then, the consequences can be severe.

Regular credit checks are one of the few ways tenants can protect themselves, even long after leaving a property. Experts recommend checking credit files at least once a year, especially after living in shared accommodation.

For landlords, the message is equally clear. Misusing tenant details, whether deliberately or through negligence, can unravel years later. Once uncovered, responsibility often shifts back where it belongs.

For this former tenant, the process ahead may still be stressful, but the outlook is hopeful. With strong evidence, clear tenancy terms, and growing awareness of landlord misuse in HMOs, there is a clear path to having the debt removed and her credit restored.

What makes this case particularly troubling is not just the financial damage, but the silence in which it happened. For years, her credit score was being quietly destroyed by an account she never opened, for a property she no longer lived in, for bills she was never meant to pay.

As more renters speak out, cases like this are shining a light on a hidden vulnerability in the rental system — one where a single dishonest act can follow someone for years, unless they discover it in time and fight back.

Leave a comment