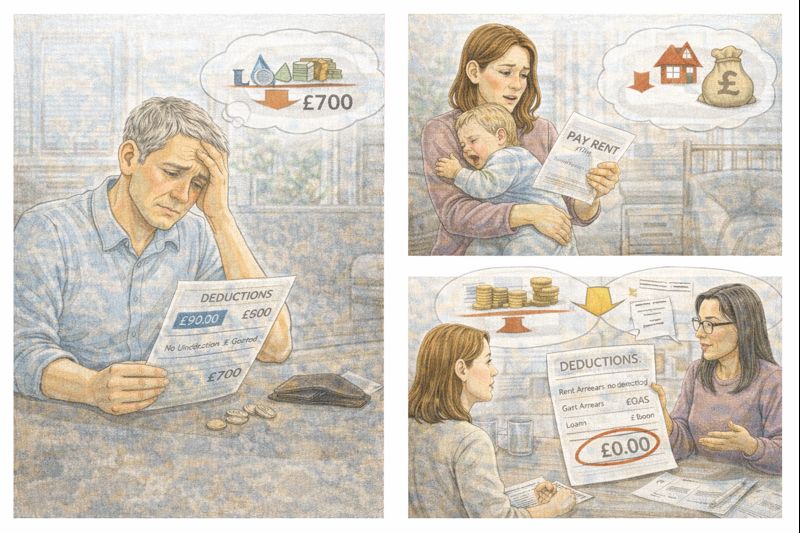

For many people on Universal Credit, the amount shown as their entitlement is not what actually reaches their bank account. Before the payment is made, money is often taken away to cover different debts and obligations. These deductions can be small at first glance, but together they can leave households with far less than they need to meet basic living costs.

This is one of the least understood but most damaging parts of Universal Credit. People plan their rent, food, and bills based on what they think they will receive, only to discover that a significant portion has already been removed. For some, deductions turn an already tight budget into something unworkable.

Deductions exist because Universal Credit is used not only to pay support, but also as a tool to recover debts. The idea behind this is simple: rather than chasing people through courts or collection agencies, the government recovers money directly from benefit payments. In practice, this approach places the burden of repayment on people who often have the least financial flexibility.

Deductions can be taken for many reasons. Common ones include repayment of Advance Payments, recovery of benefit overpayments, rent arrears owed to landlords, council tax debt, court fines, and child maintenance. Each of these may be justified on its own, but when combined, the impact can be severe.

What makes the situation especially difficult is that deductions are taken automatically. The money never reaches the claimant, which means there is no chance to prioritise spending. Rent, food, energy, and travel all have to be covered from whatever remains, even if that amount is clearly not enough.

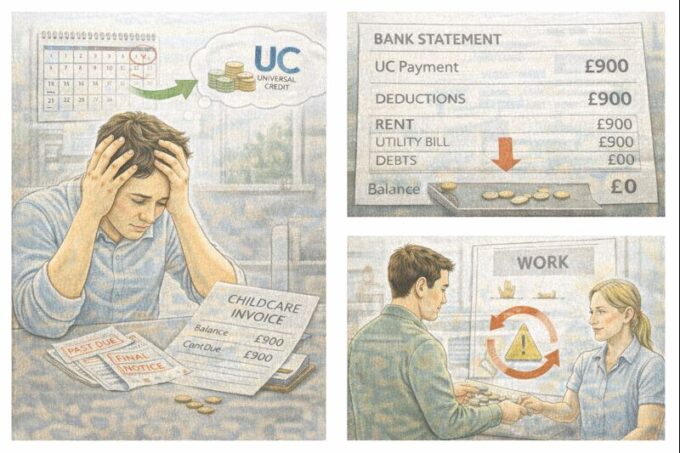

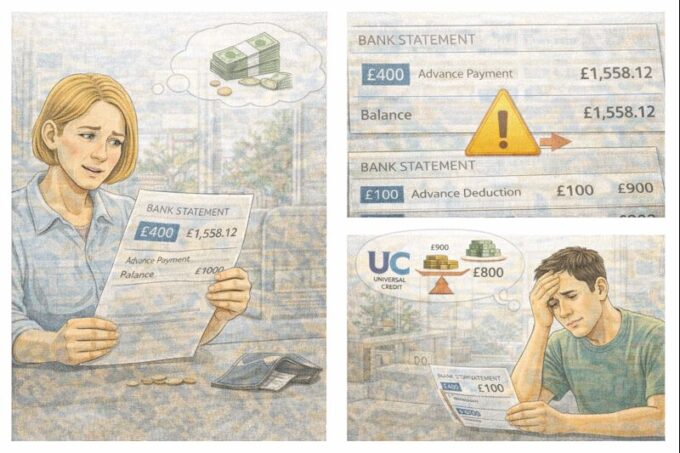

For people who took an Advance Payment at the start of their claim, deductions often begin immediately. As discussed in the previous topic, this reduces monthly income from day one. But advances are rarely the only deduction. Many claimants also face deductions for historic issues, sometimes from years earlier, which they may not have fully understood or even remembered.

Benefit overpayments are a common example. These can happen for many reasons, including changes in income, reporting errors, or administrative mistakes. Even when the overpayment was not the claimant’s fault, it is still usually recoverable. Under Universal Credit, recovery often happens through automatic deductions.

For claimants, this can feel deeply unfair. They may be repaying money they never realised they were overpaid, at a time when their current income is already low. The explanation may come in a journal message or letter, but the practical effect is immediate: less money to live on.

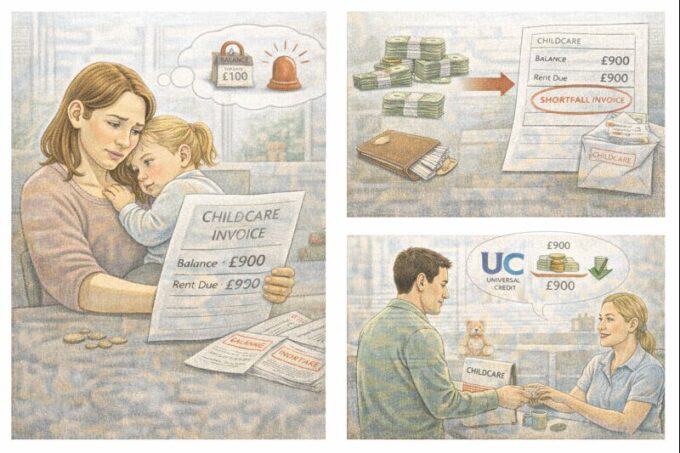

Rent arrears deductions are another major pressure point. If a claimant falls behind on rent, their landlord can request that money be taken directly from Universal Credit to clear the debt. While this may protect the landlord, it reduces the amount the claimant has available for other essentials. In some cases, people are left choosing between heating and eating.

Child maintenance deductions can also have a significant impact. Supporting children is important, but when deductions are taken from an already limited income, the remaining money may not stretch far enough to support the household the claimant currently lives in.

One of the most serious problems is how deductions interact with each other. Universal Credit allows multiple deductions at the same time, up to a maximum percentage of the standard allowance. Even when the system follows its own limits, the result can still be extremely harsh.

For someone living alone on Universal Credit, the standard allowance is meant to cover basic living costs. When a large portion of that allowance is removed, what remains may be clearly below what is needed for food, utilities, transport, and other essentials. For families, the pressure can be even greater.

This situation often leads to difficult and harmful coping strategies. People cut back on food. They delay paying energy bills and risk disconnection. They miss medical appointments because they cannot afford transport. Some turn to high-cost credit just to get through the month, creating new debts on top of existing ones.

The mental health impact of ongoing deductions is significant. Living month after month knowing that a large part of your income will disappear before you even see it creates constant stress. Many people describe feeling trapped, powerless, and exhausted. The sense that there is no way to get ahead can be overwhelming.

Another problem is that deductions are not always clearly explained. Some claimants struggle to understand why money is being taken, how long deductions will last, or whether anything can be done to reduce them. Information may be spread across online journals, letters, and statements, making it hard to get a clear picture.

This lack of clarity can lead to confusion and mistrust. People may believe money is being taken incorrectly, but not know how to challenge it. Others may assume nothing can be done and simply accept a level of hardship that could potentially be reduced.

While deductions are part of the system, they are not always fixed or unavoidable. There are steps claimants can take to protect themselves and, in some cases, reduce the impact.

The first step is understanding exactly what deductions are being made and why. Claimants should check their Universal Credit statements carefully and ask for clear explanations if anything is unclear. Knowing what each deduction is for makes it easier to decide what action to take.

If deductions are causing serious hardship, it is possible to ask for them to be reduced. This is particularly relevant for Advance Payment repayments and some other government debts. Claimants may need to explain their situation clearly and show that basic needs are not being met.

For people with multiple deductions, getting independent advice can make a big difference. Welfare advisers can help identify which deductions are negotiable and which are not. They can also help challenge incorrect deductions or request changes to repayment rates.

In some cases, alternative support can help offset the impact of deductions. Discretionary Housing Payments may help with rent shortfalls. Local welfare assistance schemes may provide food or energy support. While these do not solve the underlying problem, they can provide breathing space.

It is also important for claimants to report changes in circumstances promptly and accurately. This can help prevent new overpayments from building up and avoid future deductions.

From a wider perspective, many organisations argue that the level and structure of deductions within Universal Credit are too harsh. Recovering debts from people who are already struggling often makes it harder, not easier, for them to stabilise their lives. There are growing calls for lower deduction limits, clearer communication, and greater protection for vulnerable claimants.

For now, deductions remain a reality for many people on Universal Credit. The key is understanding them, questioning them when necessary, and seeking help early. Living with reduced income does not mean you have no options, but it does mean you may need support to navigate a complex and unforgiving system.

Deductions should never leave people unable to meet basic needs. If they do, that is not a personal failure. It is a sign that the system is not working as it should. Seeking advice, asking for adjustments, and accessing local support can make a real difference, even in a difficult situation.

Leave a comment